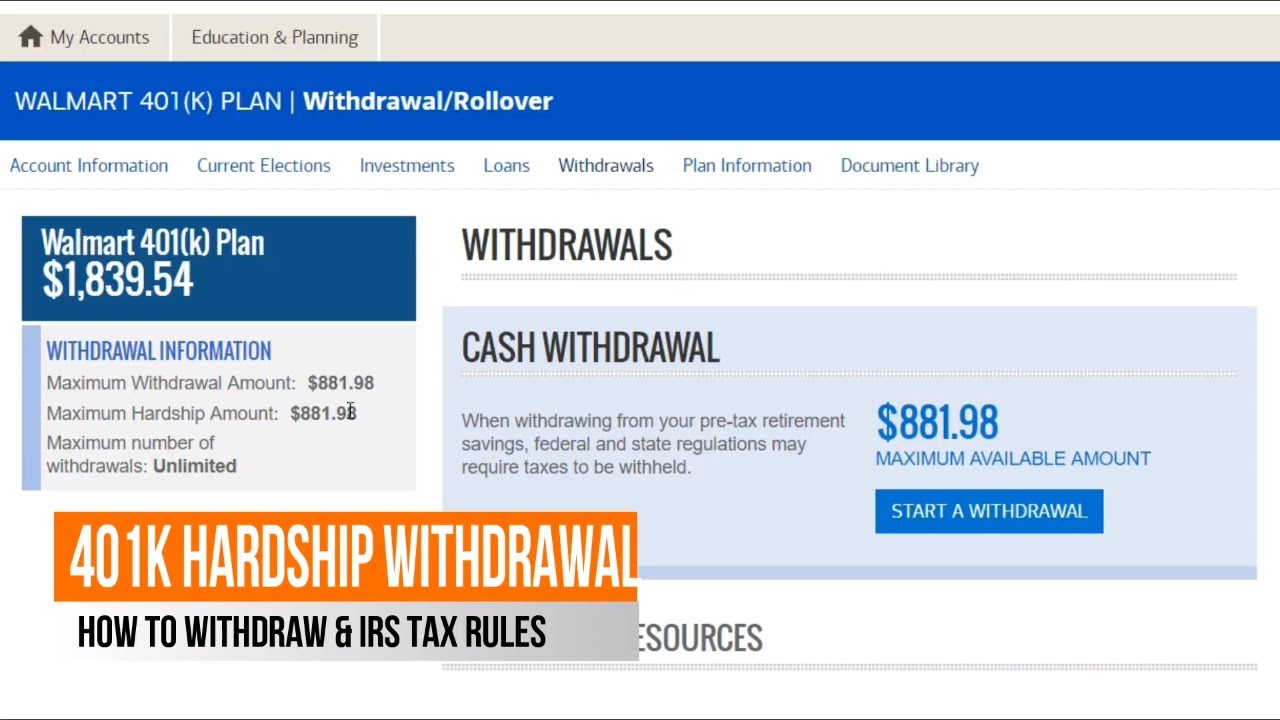

HOW TO GET A WALMART 401K HARDSHIP WITHDRAWAL & IRS TAX RULES WITH MERRILL LYNCH, CRD DISTRIBUTIONS AVAILABLE ON OR AFTER APRIL 20, 2020 A Walmart 401 Hardship Withdrawal allows workers to access retirement funds when they are going through difficult times. You must meet certain qualifications to qualify for the hardship withdrawal. If you are affected by Covid 19 new laws may allow you to receive a distribution from your account. April 2020 Update Cares Act CARES Act Coronavirus Related Distribution (CRD) distributions will be available online on or after April 20, and will be processed daily. Phone-based requests may take up to 10 days to process. If your plan adopts the CARES Act CRD provision and you meet the eligibility requirements, a CRD allows you to withdraw 100% of your vested account balance up to $100,000 and will not be subject to the additional 10% federal tax assessed if under age 59 ½ or the normal 20% tax withholding. This option is available up until December 31, 2020. www.benefits.ml.com April 2021 Update: More options have been added to help you access the hardship withdrawal. Login to the website and click Walmart 401k plan. In Account Summary look for Actions on the page and click view your withdrawal and rollover options. Under withdrawals click start a withdrawal. You must go through the next few pages and provide the requested documentation online or by mail. Those who have been diagnosed with COVID-19; who have experienced adverse financial consequences as a result of being quarantined, furloughed, or laid off; or who have otherwise lost income (including because of having to be home to provide child care. How to withdraw funds from your 401k and the irs tax penalties you might incur. If you have an emergency or are in dire need of funds this may be an option for you. Taking your assets as a taxable cash distribution has some potential advantages including: You have immediate access to your assets. There are also several potential disadvantages to taking a taxable cash distribution including: You lose the potential advantage of tax deferred compounding. The distribution will be subject to federal income tax as well as any applicable state and/or local income tax. If you are under age 59½, you may be subject to a 10% early withdrawal additional tax, unless an exception applies 20% of the distribution may be withheld at the time of distribution to comply with mandatory withholding rules. How to qualify for a hardship distribution: There are two steps to determining if you qualify for a hardship withdrawal from the Walmart 401(k)Plan (the “Plan”). First, you must have an immediate and heavy financial need in one of these categories: 1. Burial or funeral expenses. 2. Eviction/foreclosure. 3. Home repair expenses. 4. Medical expenses. 5. Purchase home/land. 6. Tuition expenses. Second, you must have received all currently available distributions (other than hardship distributions) and all available nontaxable loans from this Plan and all other plans maintained by Walmart or an affiliate. Hardship withdrawals and your payroll contributions: If your hardship withdrawal request is approved, the IRS imposes restrictions on certain benefits. Specifically, for six months following your hardship withdrawal, the following restrictions apply: -For hardship distributions taken prior to January 1, 2019, tax law requires a 6-month prohibition on salary deferrals after taking a hardship distribution. -Effective for hardship distributions taken on or after January 1, 2019, tax laws will permit you to continue making contributions to the plan after taking a hardship withdrawal. - You may not make contributions to the 401(k) Plan, any other qualified retirement plan or non-qualified retirement plan (like the Deferred Compensation Matching Plan). (Old Rules Prior to Jan 1, 2019) - You may not make contributions to the Associate Stock Purchase Plan or any similar plan. - You may not exercise stock options available to you through the Walmart Stock Incentive Plan or any similar plan. Also, if you request a hardship withdrawal within five days of the record date of a dividend on the Walmart stock in your Plan account and you have the right to elect a cash distribution of the dividend, tax laws require that the dividend be paid automatically to you in cash. Once the suspension period related to hardship withdrawal is over, you can enroll again in the 401(k) Plan or the Associate Stock Purchase Plan with an online benefits enrollment session on walmartbenefits.com or the WIRE. ...(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

https://inflationprotection.org/walmart-401k-hardship-withdrawal-with-merrill-lynch-irs-tax-rules-crd-distributions-april-20/?feed_id=49785&_unique_id=639a37218fbca #Inflation #Retirement #GoldIRA #Wealth #Investing #401khardshipwithdrawal #401kloan #hardshipwithdrawal401k #merrilllynch401k #merrilllynchwalmart #merrilllynchwalmart401kcashout #merrilllynchwalmart401ktermsofwithdrawal #merrilllynchwalmart401kwithdrawal #walmart401k #walmart401kcashout #walmart401khardship #walmart401khardshiprules #WALMART401KHARDSHIPWITHDRAWAL #walmart401khardshipwithdrawalrules #walmart401kloan #walmart401kwithdrawalrules #401k #401khardshipwithdrawal #401kloan #hardshipwithdrawal401k #merrilllynch401k #merrilllynchwalmart #merrilllynchwalmart401kcashout #merrilllynchwalmart401ktermsofwithdrawal #merrilllynchwalmart401kwithdrawal #walmart401k #walmart401kcashout #walmart401khardship #walmart401khardshiprules #WALMART401KHARDSHIPWITHDRAWAL #walmart401khardshipwithdrawalrules #walmart401kloan #walmart401kwithdrawalrules

Comments

Post a Comment