Tax Difference between LLC and S-Corp - LLC vs. S Corporation explanation (FREELANCE TAX & 1099 Tax)

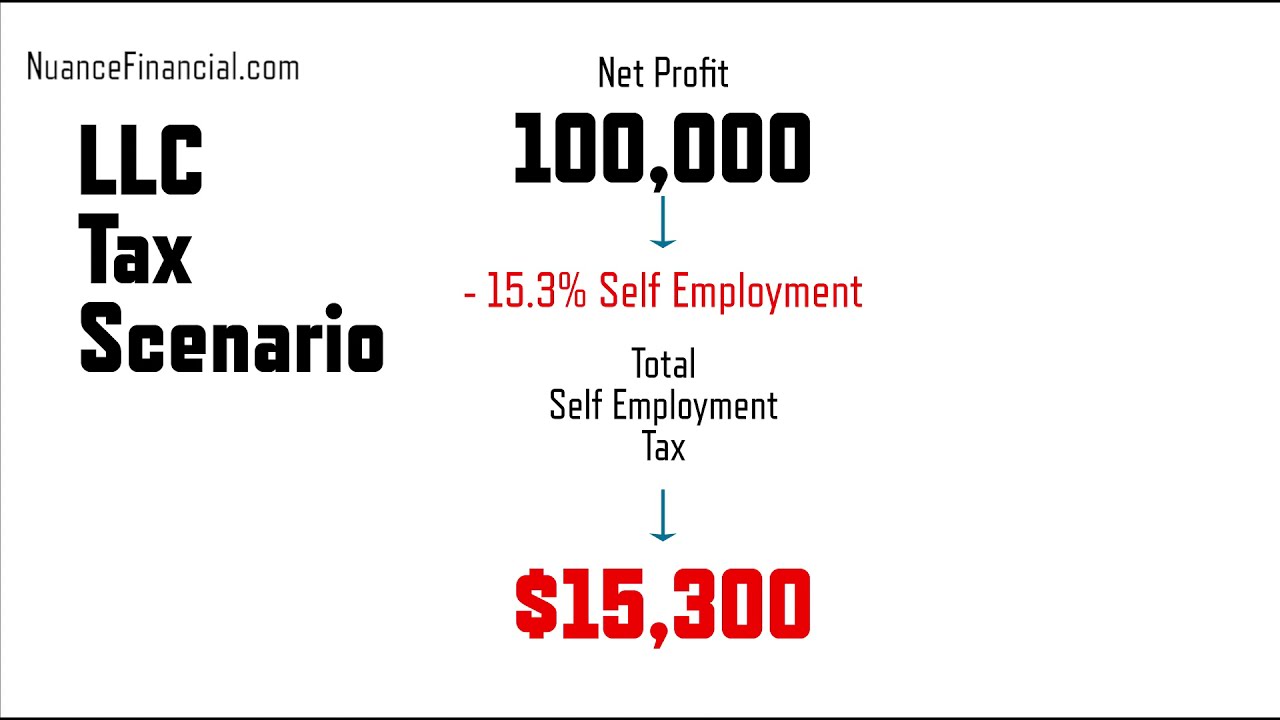

What's the tax difference between and LLC and an S Corporation? Will you save taxes if you convert from an LLC taxed as a sole prop, to being taxed as a sub chapter s? How much taxes will you save if you become an S-Corp? If you want to know the tax difference between an LLC and an S-Corp, then check out this video.! In this video, I'm going to explain exactly what the difference is between an LLC and an S-Corporation, particularly when it comes to your self employment taxes, (aka SE Taxes), which are your medicare and social security taxes. how do you reduce your business taxes? Well, there are three major tax reductions strategies: Business entity optimization, benefits and retirement plans like 401k, SEP IRA, and Simple IRA"s, and then utilizing real estate investments. UPDATE ON NUANCE FINANCIAL - I NO LONGER RECOMMEND NUANCE FINANCIAL, but instead HIGHLY recommend Xendoo Accounting, because it's faster, cheaper, higher quality service, and nation wide. If you're looking for a payroll, bookkeeping, tax return, tax planning (with CPA support), then check out my AFFILIATE LINK for XENDOO Accounting here: If we added value, consider supporting me and my family on Patreon. We're committed to creating free business, tax and accounting content, and we're thrilled that we've had the support of our little community! Follow us at: Twitter - Facebook - Instagram @feedbackwrench What's the tax difference between an LLC and an S-Corp? What's better, an S Corp or an LLC? How to convert to an S Corporation? Are there tax savings when you become an S-Corp? What business type should I be? How to choose a business type? There are dozens of questions that people have concerning their business entity type. The bottom line is that people are usually trying to pay their fair share and not a penny more - that's the most important thing to them. If you're looking for tax planning advice, ways to reduce your taxes, legal tax loopholes, the best tax loopholes for small business or the best tax write offs for small business - the foundation starts with your business entity type. You should make a wise decision about becoming a limited liability company taxed as a sole proprietor or an S-Corp, because it might save you in self employment, social security and medicare taxes. Social security taxes for an S-Corp are important to figure out! So is figuring out the medicare taxes on an LLC or an S-corp. We hope this video helps you out a ton!...(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

https://inflationprotection.org/tax-difference-between-llc-and-s-corp-llc-vs-s-corporation-explanation-freelance-tax-1099-tax/?feed_id=58570&_unique_id=63bbed3a0ba2c #Inflation #Retirement #GoldIRA #Wealth #Investing #1099tax #1099taxes #1120s #beneftisofanscorp #convertingtoanscorp #differencebetweenllcandscorp #freelancetaxes #freelancerllc #howtosavetaxeson1099 #LLC #llcvscorporation #llcvsscorp #nuancefinancial #scorpaccounting #scorpvsllc #SCorp #scorp #smallbusinesstaxes #socialsecuritytaxes #solepropvs.corporation #subchapterstaxation #tax #taxsavingswithscorp #taxeson1099 #xendoo #SEPIRA #1099tax #1099taxes #1120s #beneftisofanscorp #convertingtoanscorp #differencebetweenllcandscorp #freelancetaxes #freelancerllc #howtosavetaxeson1099 #LLC #llcvscorporation #llcvsscorp #nuancefinancial #scorpaccounting #scorpvsllc #SCorp #scorp #smallbusinesstaxes #socialsecuritytaxes #solepropvs.corporation #subchapterstaxation #tax #taxsavingswithscorp #taxeson1099 #xendoo

Comments

Post a Comment