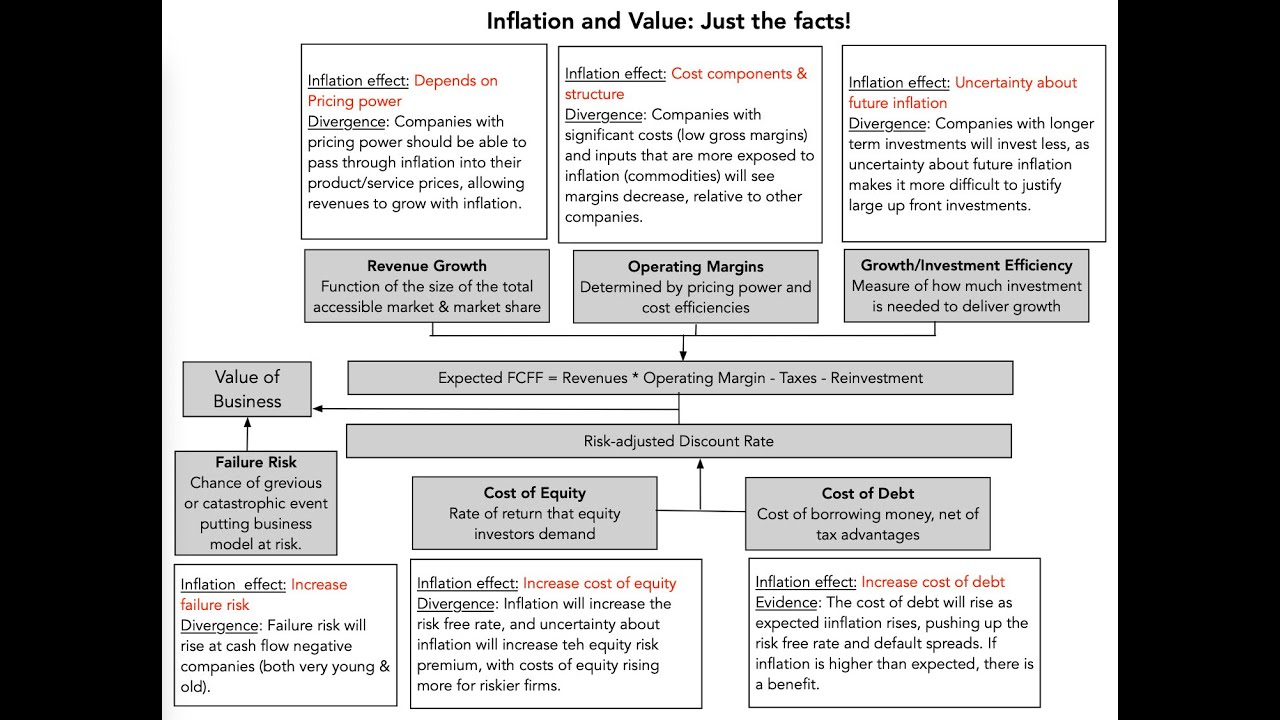

In this session, I look at how inflation can affect the value of a company, through its value drivers, from growth to margins to reinvestment and risk. I argue that companies with significant pricing power, with low input costs and investments of short duration and high flexibility will have the strongest ability to pass inflation into their cashflows. The capacity to generate high and stable earnings, with little default risk, will determine how inflation affects discount rates. As a consequence, the effect of inflation, and in particular, unexpected inflation, can vary widely across companies. Looking at the last nine decades of US stock returns, I note that small cap and low price to book stocks have done much better during periods of high inflation. Focusing in on 2022, when inflation has been the lead story driving markets, I document that small cap and low price to book stocks have outperformed markets, just as in the 1970s. Adding on measures for risk and cash flows, it looks like less risky and higher cash flow (operating and dividend) have also outperformed the market. While value investors will view this as vindication, after a decade in the wilderness, it is still too early to draw the conclusion that value is back. Slides: Blog Post: ...(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Inflation is a constant economic concern that has a significant impact on different industries and companies. Inflation refers to a general increase in prices of goods and services over time, leading to a reduction in the purchasing power of currencies. It's important for companies to track and mitigate the risks posed by inflation, as it affects their bottom line, growth prospects, and competitiveness in the marketplace. Corporate exposure to inflation refers to the degree to which businesses are affected by price increases in the economy. Some industries may be more vulnerable to the effects of inflation than others. Companies in the agriculture and energy sectors, for example, may face higher costs for raw materials and transportation, which could reduce their profit margins. Meanwhile, businesses in the healthcare and technology sectors may be less impacted by inflation due to their relatively low input costs and high demand. To address inflationary pressures, companies need to take a proactive approach to identifying and mitigating risks. One strategy is to conduct regular assessments of the firm's exposure to inflation in different scenarios. This analysis may include a review of costs, pricing strategies, supplier contracts, and consumer demand trends. Another strategy is to hedge against inflation through various financial instruments such as futures, options, and inflation-protected bonds. These instruments provide a way for companies to manage their financial risk and reduce vulnerabilities to inflationary pressures. However, hedging comes with its associated risks, and companies should only use these instruments after carefully considering their financial implications. Finally, companies should also focus on improving operational efficiency and cost management to minimize the impact of inflation. This may involve implementing cost-saving measures, such as increasing productivity, reducing waste, and renegotiating supplier contracts. While inflation can have a significant impact on companies, effective risk management strategies can help firms navigate these challenges and maintain their competitive edge. It's important for businesses to prioritize proactive measures to mitigate the effects of inflation, including regular assessments of their exposure, hedging strategies, and cost management efforts. By doing so, companies can better protect their bottom lines and maintain growth over the long term. https://inflationprotection.org/an-inflation-follow-up-company-exposure-to-inflations-effects/?feed_id=79178&_unique_id=64155b7a4fa8c #Inflation #Retirement #GoldIRA #Wealth #Investing #Corporate #Finance #InvestDuringInflation #Corporate #Finance

Comments

Post a Comment