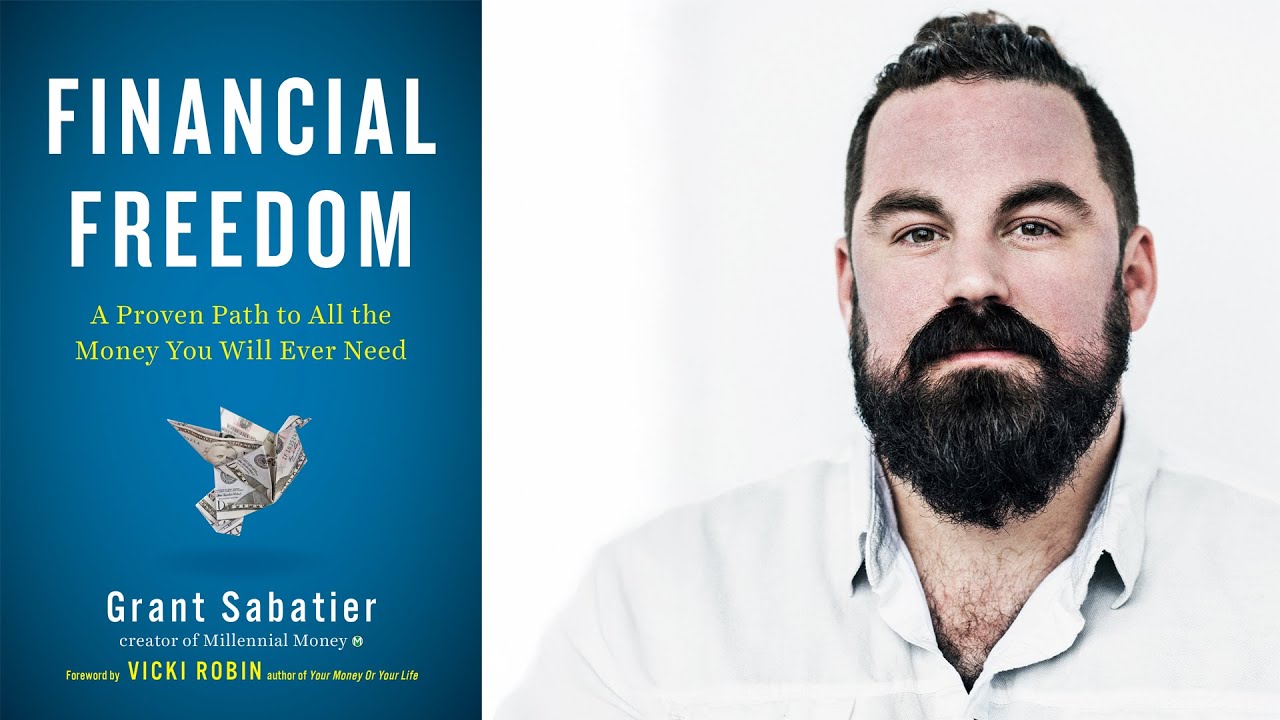

Grant Sabatier (author, Financial Freedom) share some of the steps that led him from $2.26 in the bank to over a million bucks in just 5 years, and the myth that he believes is the #1 barrier keeping the rest of us from achieving the same thing. Plus, a conversation about Senator Elizabeth Warren’s wealth tax proposal, Joe and Big Al answer a question about keeping taxes in mind as part of an investing strategy, and a look at the complete disaster that was the Fyre Festival. :48 - How Grant Sabatier Became a Millennial Millionaire 14:45 - Grant Sabatier on How You Can Become a Millionaire, Too 29:42 - I Make Too Much to Deduct Traditional IRA Contributions. Why Not Just Go After-Tax? 35:44 - Joe and Big Al's Take on "The Wealth Tax" 42:53 - The Disastrous Fyre Festival Pure Financial Advisors, LLC is a fee-only Registered Investment Advisor providing comprehensive retirement planning services and tax-optimized investment management to thousands of people across the nation. Schedule a free assessment with an experienced financial professional: Office locations: Ask Joe & Big Al On Air: Subscribe to our YouTube channel: Subscribe to the Your Money, Your Wealth® podcast: IMPORTANT DISCLOSURES: • Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, Inc. A Registered Investment Advisor. • Pure Financial Advisors Inc. does not offer tax or legal advice. Consult with a tax advisor or attorney regarding specific situations. • Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. • Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. • All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. • Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors. #YourMoneyYourWealth #YMYW #YourMoneyYourWealthPodcast...(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Achieving financial freedom is a top priority for many people. However, there are certain myths and beliefs that can hold us back from attaining our financial goals. Grant Sabatier, author of "Financial Freedom: A Proven Path to All the Money You Will Ever Need", sheds light on the #1 barrier to financial freedom in a recent episode of the Your Money Your Wealth podcast (#207). According to Sabatier, the biggest obstacle to financial freedom is the belief that we need to be perfect with our finances. Many of us have the notion that we need to have everything figured out before we can start investing or saving for the future. We think we need to have a certain amount in savings, pay off all our debts, and have a high income before we can even think about building wealth. This belief is not only untrue but can be detrimental to our financial success. Sabatier argues that waiting for everything to be perfect often leads to inaction, and inaction leads to missed opportunities. He notes that no one is perfect with their finances, and there will always be something to learn or improve upon. But, the important thing is to start taking action towards our financial goals, even if it's just a small step. Sabatier advises listeners to focus on progress, not perfection. Instead of seeking perfection, we should aim for improvement. We don't need to have all the answers or know exactly what to do. We can learn as we go and make adjustments along the way. The key is to take action and not let the fear of imperfection hold us back. Another piece of advice Sabatier offers is to embrace failure. Failure is a natural part of the process, and we should use it as an opportunity to learn and grow. It's important to not let fear of failure paralyze us and keep us from taking action towards our financial goals. Instead, we should view failure as feedback and make adjustments accordingly. In conclusion, the belief that we need to be perfect with our finances is the #1 barrier to financial freedom. This belief can lead to inaction, missed opportunities, and a fear of failure. Instead, we should focus on progress, not perfection, and embrace failure as a necessary part of the process. With this mindset, we can take action towards our financial goals and achieve the freedom we desire. https://inflationprotection.org/the-1-obstacle-to-financial-freedom-debunked-grant-sabatier-on-ymyw-podcast-ep-207/?feed_id=92485&_unique_id=644cb2bc57522 #Inflation #Retirement #GoldIRA #Wealth #Investing #AlanClopine #elizabethwarren #FinancialIndependenceRetireEarly #financialplanningbrea #financialplanningirvine #financialplanningsandiego #fyrefestival #grantsabatier #grantsabatierfinancialfreedom #millennialmillionaire #purefinancial #purefinancialadvisors #traditionaliracontributions #WealthTax #wealthtaxelizabethwarren #YourMoneyYourWealth #yourmoneyyourwealthjoeanderson #YourMoneyYourWealthpodcast #SpousalIRA #AlanClopine #elizabethwarren #FinancialIndependenceRetireEarly #financialplanningbrea #financialplanningirvine #financialplanningsandiego #fyrefestival #grantsabatier #grantsabatierfinancialfreedom #millennialmillionaire #purefinancial #purefinancialadvisors #traditionaliracontributions #WealthTax #wealthtaxelizabethwarren #YourMoneyYourWealth #yourmoneyyourwealthjoeanderson #YourMoneyYourWealthpodcast

Comments

Post a Comment