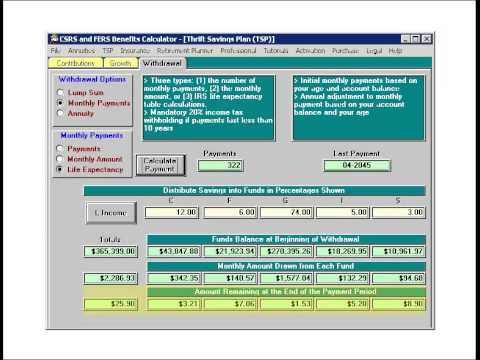

This video will demonstrate the withdrawal options for TSP....(read more)

LEARN MORE ABOUT: Thrift Savings Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the military. It offers several withdrawal options for participants to access their funds in retirement. Here are the most common TSP withdrawal options: 1. Single payment: This option allows you to withdraw your TSP account balance in a lump sum payment. You can transfer the payment to an IRA or use the money as you see fit. However, lump sum payments can have significant tax implications, especially if you withdraw a large amount at once. 2. Monthly payments: This option involves receiving a fixed monthly payment from your TSP account. You can choose to receive payments for a set period or for the rest of your life. This option can provide a steady income stream in retirement but may limit your access to your funds. 3. Life annuity: A TSP annuity provides regular payments for your lifetime. This option guarantees a fixed income stream, but payments stop when you die. You cannot change the payment amount or receive the remaining balance as a lump sum. 4. Partial withdrawals: You can also make partial withdrawals from your TSP account. This option allows you to access your funds without depleting your entire account balance. However, partial withdrawals may be subject to taxes and other fees. Before choosing a TSP withdrawal option, you should consider your retirement goals, financial situation, and tax implications. It is crucial to understand the tax laws and regulations that apply to your TSP account to avoid unexpected tax consequences. You may want to consult a financial advisor or tax professional to help you make an informed decision about your TSP withdrawal options. https://inflationprotection.org/withdrawal-options-for-the-thrift-savings-plan-tsp/?feed_id=85310&_unique_id=642f953c1fd13 #Inflation #Retirement #GoldIRA #Wealth #Investing #BRACCalculator #CivilServiceRetirementSystemGovernmentAgency #FederalEmployeesRetirementSystemGovernmentAgency #FederalRetirementCalculator #PostalRetirementCalculator #thriftsavingsplan #tspcalculator #ThriftSavingsPlan #BRACCalculator #CivilServiceRetirementSystemGovernmentAgency #FederalEmployeesRetirementSystemGovernmentAgency #FederalRetirementCalculator #PostalRetirementCalculator #thriftsavingsplan #tspcalculator

Comments

Post a Comment