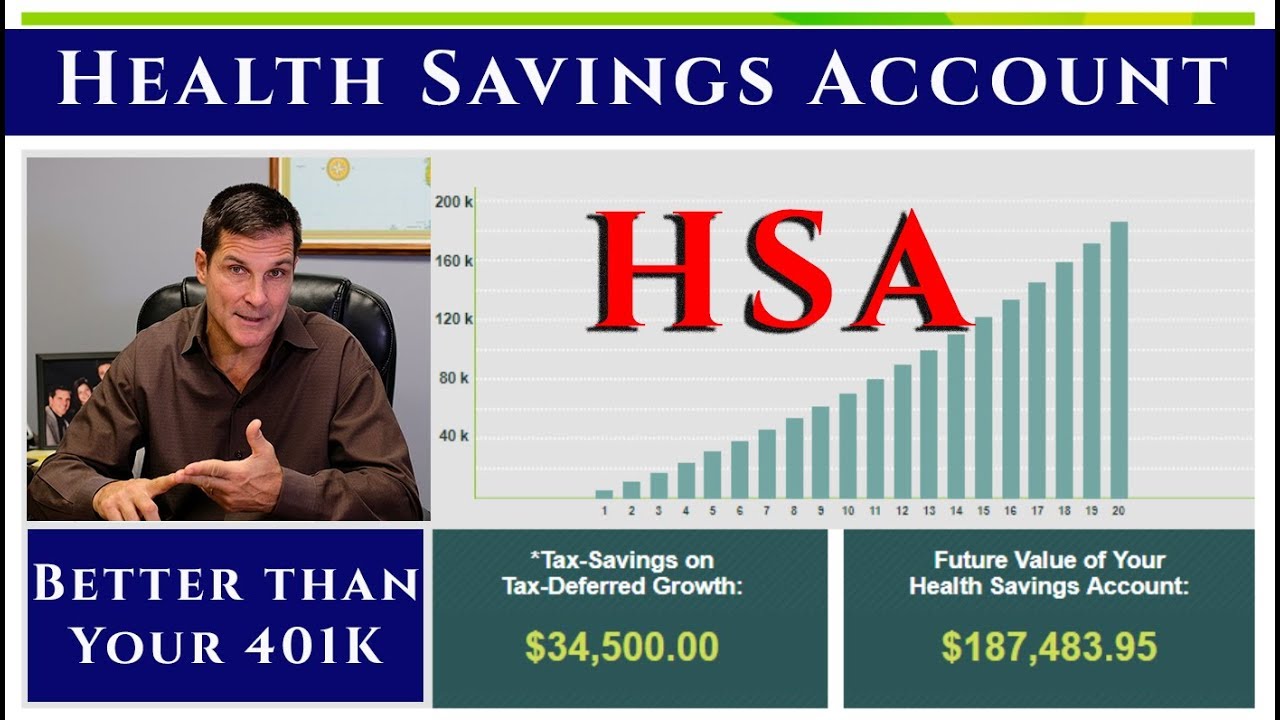

5 GREAT REASONS TO LOVE HSA'S! 2022 contributions -$3,650/individual , $7,300 Couple and $1,000 catch up if over age 55 Qualifying High Deductible Health Plan (HDHP) annual out-of-pocket cannot exceed $6,900 for self coverage and $13,800 for family. Link to HDHP video - High Deductible Health Plans (HDHP) With HSA! SCHEDULE A ZOOM MEETING WITH BRAD: Get more info today! Click below: You can reach me at brad@fortunefinancialgroup.com or website www.fortunefinancialgroup.com Link to Deeper Dive into HSA video - HSA Accounts - a Deep Dive Into Health Savings Accounts How much can you contribute? Who Can Use HSA’s? What about the burden of having a high medical insurance deductible? How does the money grow in a Health Saving Account? Blog Post - Health Savings Accounts are Fantastic for Retirement! Learn about best ways to invest money in 2018. And don’t forget to visit and learn more here: Don’t Forget To Subscribe - ...(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

When it comes to planning for retirement, many people look to traditional retirement accounts like 401ks. However, there is another option for saving for retirement that may be even better: Health Savings Accounts (HSAs). An HSA is a tax-advantaged savings account that is used to pay for qualified medical expenses. Many people often overlook this account as just another expense and don’t consider it as a retirement account. However, if used properly, an HSA can be more beneficial than a 401k, especially for those who are young and healthy. One of the biggest advantages of an HSA is the tax benefits it offers. Contributions to an HSA are tax-deductible, which means that individuals can reduce their taxable income by making contributions to their HSA account. Any earnings on the account, such as interest or investment gains, are tax-free as long as they are used to pay for qualified medical expenses. And withdrawals for any non-qualified expenses are taxed at the same rate as 401k withdrawals. Additionally, an HSA can be used as a retirement account, while a 401k is only designed for retirement savings. Money in an HSA can be invested, just like a 401k, and allowed to compound over time. The difference is that HSA funds can be withdrawn tax-free, even after retirement, as long as they are used to pay for qualified medical expenses. This is especially important as healthcare costs continue to rise, with the average retiree needing to budget around $285,000 for medical expenses during retirement. By having an HSA that has been allowed to grow, individuals can have peace of mind knowing that they have funds set aside specifically for healthcare expenses in retirement. Another advantage of an HSA is its flexibility. Unlike a 401k, individuals can withdraw funds from their HSA at any time, for any reason. While individuals will have to pay taxes and possible penalties for non-qualified withdrawals, they still have more flexibility and control over their money. Furthermore, HSAs offer portability, meaning the account remains with the individual regardless of job changes or retirement. On the other hand, with a 401k, an individual has to rollover their funds to a new employer or an IRA. Overall, the decision to use an HSA over a 401k will depend on an individual’s financial situation, health, and retirement goals. However, for those who are young and healthy, an HSA can be a valuable asset for retirement planning, offering tax benefits, flexibility, and portability that a 401k does not. As a Certified Financial Planner, I highly recommend incorporating an HSA into your retirement planning strategy and maximizing its potential benefits. https://inflationprotection.org/cfp-explains-why-hsa-is-a-better-choice-than-a-401k/?feed_id=94403&_unique_id=645463a85b939 #Inflation #Retirement #GoldIRA #Wealth #Investing #401k #401kexplained #401kinvesting #bradrosley #daveramseyhsa #financialadvisorglenellyn #healthinsuranceforselfemployed #healthsavingsaccount #healthsavingsaccountexplained #healthsavingsaccountfidelity #highdeductiblehealhplan #howtoinvesthsa #howtolowerinsurancepremiums #howtosetuphsa #HSA #hsaaccounts #hsaexplained #hsainvestment #Retirement #retirementplanning #saving #Taxfreeinvestment #whymaxoutyourhsa #whyshouldiuseahsa #401k #401k #401kexplained #401kinvesting #bradrosley #daveramseyhsa #financialadvisorglenellyn #healthinsuranceforselfemployed #healthsavingsaccount #healthsavingsaccountexplained #healthsavingsaccountfidelity #highdeductiblehealhplan #howtoinvesthsa #howtolowerinsurancepremiums #howtosetuphsa #HSA #hsaaccounts #hsaexplained #hsainvestment #Retirement #retirementplanning #saving #Taxfreeinvestment #whymaxoutyourhsa #whyshouldiuseahsa

Comments

Post a Comment