Join my brand New newsletter for weekly in-depth report & notes. Join this channel to get access to perks: For Sponsorships Email MichaelCowan@lighthouseagents.com For other inquires email me Michaelinvests11@gmail.com ECONOMIC CATACLYSM! Home Prices Declines Hit Decade High for The Real Estate Market HOUSE PRICE CRASH BEGINS! This Will Rival 2008 Please note: some of these links are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you. Michael Cowan is not A financial adviser. The information provided in this video is for general information only and should not be taken as financial advice. There are risks involved with stock market or other asset investing and consumers should not act upon the content or information found here without first seeking advice from an accountant, financial planner, lawyer or other professional. Consumers should always research companies individually and define a strategy before making decisions. Michael Cowan is not liable for any loss incurred, arising from the use of, or reliance on, the information provided by this video....(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

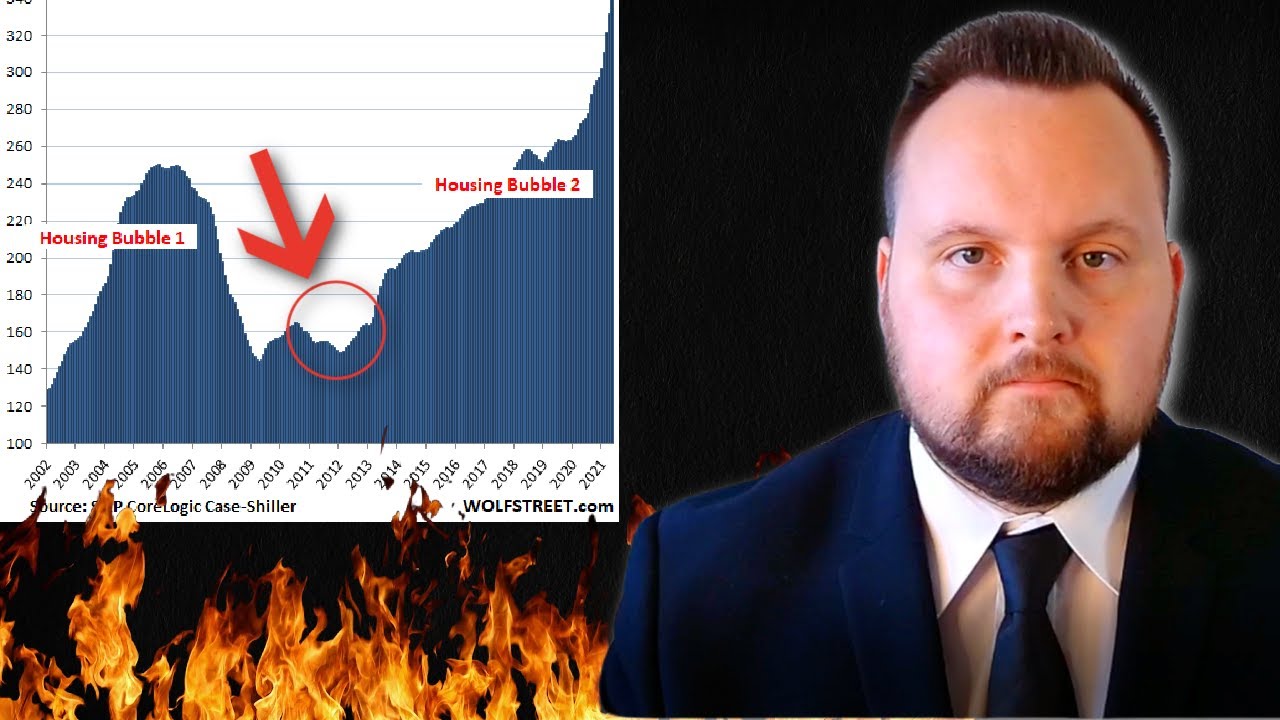

House prices have always been a topic of interest for most of us, but it seems that the recent trends have taken the market by storm. Yes, you guessed it right, house prices have just done it! The market has witnessed a sudden surge in house prices and the demand for properties has skyrocketed. Let's have a look at the recent statistics to know more about this phenomenon. According to the data released by the National Association of Realtors(NAR), the median existing-home price for all housing types in May was $350,300, up 23.6% from May 2020 ($283,500), as every region recorded price increases. This marks the 111th straight month of year-over-year gains. Why did this happen? The answer is simple - the pandemic. The pandemic brought a lot of changes, one of them being the concept of 'Work from Home' and the need for larger spaces. People started realizing the importance of owning a comfortable home where they can work and relax at the same time. Moreover, low-interest rates played a significant role as well. People have been taking advantage of the low-interest rates and buying properties. Another reason for this sudden surge in house prices is the shortage of supply. The pandemic has disrupted the construction and supply chain, causing a delay in building new homes. Due to this, the number of available properties for sale has decreased, leading to an increase in demand and ultimately the prices. These factors have paved the way for the current market trend, which is expected to continue for some time. However, experts predict that the market will eventually stabilize, and the house prices will reach equilibrium. What does this mean for buyers and sellers? Well, for sellers, this is an excellent opportunity to sell their properties for a higher price. On the other hand, for buyers, this might not be an ideal time to buy a house unless it's an urgent requirement. They might need to wait for the market to stabilize to get a fair price. In conclusion, the sudden surge in house prices is an outcome of various factors and a shift in priorities. It's essential to keep an eye on the market trends and analyze them before making any investment decisions. https://inflationprotection.org/house-prices-achieve-it/?feed_id=103111&_unique_id=6477b16f53884 #Inflation #Retirement #GoldIRA #Wealth #Investing #Bitcoin #crash #Cryptocurrency #fed #federalreserve #Gold #housingmarket #housingmarketcrash #investing #MichaelCowan #money #realestate #realestatecrash #silver #stockmarket #Stocks #wealth #InvestDuringInflation #Bitcoin #crash #Cryptocurrency #fed #federalreserve #Gold #housingmarket #housingmarketcrash #investing #MichaelCowan #money #realestate #realestatecrash #silver #stockmarket #Stocks #wealth

Comments

Post a Comment