Subscribe to our channel As countries around the world struggle to emerge from the global economic crisis, are institutions such as the International Monetary Fund (IMF) part of the problem - or the solution? Critics accuse the organisation of pushing poorer nations deeper into debt and poverty through its conditional loans. At Al Jazeera English, we focus on people and events that affect people's lives. We bring topics to light that often go under-reported, listening to all sides of the story and giving a 'voice to the voiceless.' Reaching more than 270 million households in over 140 countries across the globe, our viewers trust Al Jazeera English to keep them informed, inspired, and entertained. Our impartial, fact-based reporting wins worldwide praise and respect. It is our unique brand of journalism that the world has come to rely on. We are reshaping global media and constantly working to strengthen our reputation as one of the world's most respected news and current affairs channels. Social Media links: Facebook: Instagram: Twitter: Website: google+: ...(read more)

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

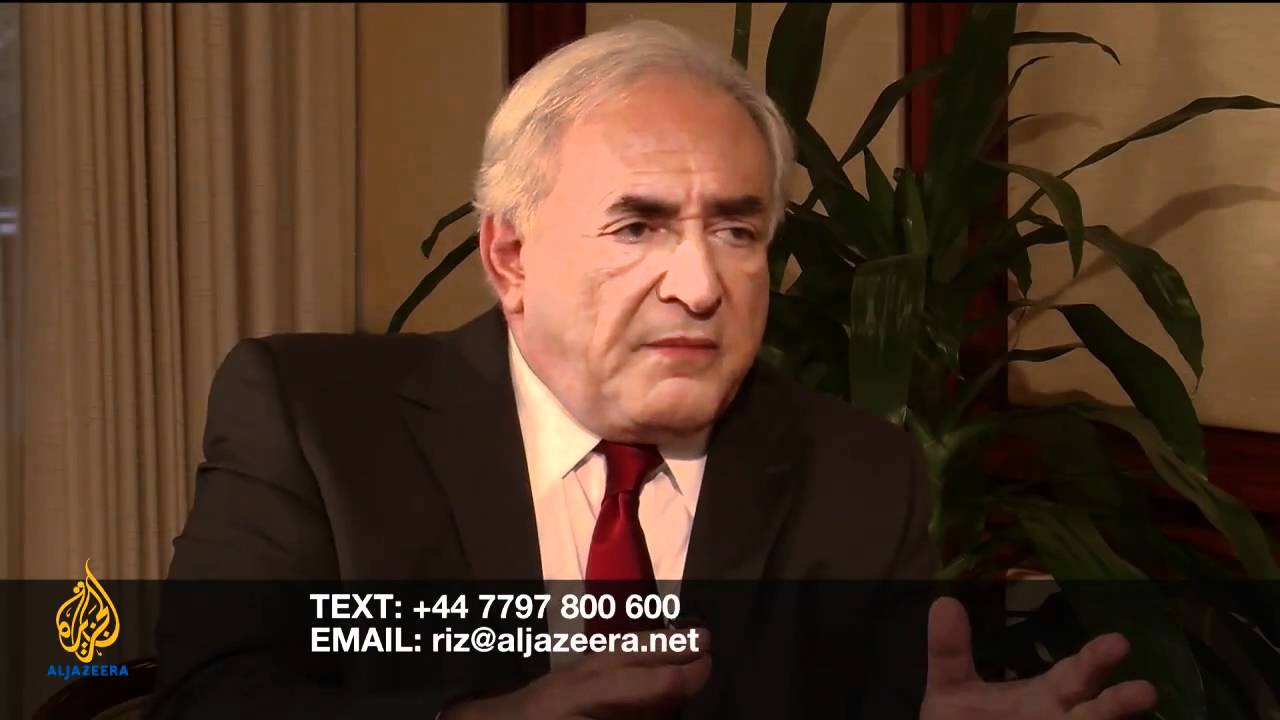

Title: Riz Khan - Does the IMF Help or Hurt Poor Nations? Introduction: The International Monetary Fund (IMF) is an international organization established with the primary aim of fostering global economic stability and assisting member countries during financial crises. However, over the years, its impact on poor nations has been a subject of debate. In this article, we will explore the perspectives of renowned journalist and broadcaster, Riz Khan, on the question of whether the IMF helps or hinders the progress of impoverished nations. About Riz Khan: Riz Khan is a highly respected journalist and television presenter, known for his thought-provoking interviews and insightful analysis of global affairs. Throughout his career, he has interviewed influential figures and covered a wide range of topics, including economic policies and their impact on developing nations. Riz Khan's Perspective: Riz Khan believes that the IMF's intentions are noble, aiming to stabilize economies and tackle financial imbalances in poor countries. Nonetheless, he also emphasizes that the implementation of IMF policies often has unintended consequences, particularly for the most vulnerable populations. Positives of IMF Assistance: Khan recognizes that the IMF's financial assistance can provide short-term relief and help countries avert immediate crises. The organization lends money to countries facing balance of payments problems, offering financial stability and boosting investor confidence. Additionally, the IMF provides technical expertise and advice on economic reforms, assisting nations in achieving long-term economic stability. Critique of IMF Policies: However, Khan raises concerns regarding some of the conditions attached to IMF loans. Oftentimes, the organization requires recipient countries to implement austerity measures and structural reforms, which may have adverse effects on their economies and the population at large. Austerity measures, such as cutting public spending, can potentially deepen poverty and widen social inequalities. Khan argues that these policies disproportionately affect the vulnerable segments of society, such as the poor, who bear the brunt of reduced public services, including healthcare and education. Moreover, the requirement for structural reforms can sometimes lead to the privatization of public assets, including essential services like water and electricity. Khan highlights that privatization, when not properly regulated, can lead to price hikes and reduced accessibility, negatively impacting the poor. Alternative Approaches: Khan suggests that the IMF should adopt a more nuanced and flexible approach. He proposes that instead of imposing "one size fits all" policies, the IMF should tailor its assistance to the socio-economic conditions and needs of each country. Supporters of the IMF argue that its policies can encourage fiscal discipline and promote long-term sustainable growth. However, Khan urges the organization to prioritize the welfare of the poor and marginalized, emphasizing that economic stability should not come at their expense. Conclusion: In assessing the impact of the IMF on poor nations, Riz Khan acknowledges the organization's positive contributions in stabilizing economies and averting financial crises. However, he stresses the need for a greater focus on social welfare and the careful evaluation of the impact of IMF conditions on the most vulnerable populations. By promoting more targeted policies and considering the unique circumstances of each country, the IMF can enhance its effectiveness in supporting long-term sustainable development in impoverished nations. https://inflationprotection.org/the-impact-of-the-imf-on-poor-nations-beneficial-or-detrimental/?feed_id=113128&_unique_id=64a0613a2a25f #Inflation #Retirement #GoldIRA #Wealth #Investing #westernimperialism #aljazeera #DominiqueStraussKahn #fightpoverty #globaleconomiccrisis #IMF #internationalmonetaryfund #JamesVreeland #loans #MilleniumDevelopmentgoals #Poverty #RizKhan #rizkhan #BankFailures #westernimperialism #aljazeera #DominiqueStraussKahn #fightpoverty #globaleconomiccrisis #IMF #internationalmonetaryfund #JamesVreeland #loans #MilleniumDevelopmentgoals #Poverty #RizKhan #rizkhan

Comments

Post a Comment