...(read more)

...(read more)

HOW TO: Hedge Against Inflation REVEALED: Best Investment During Inflation HOW TO INVEST IN GOLD: Gold IRA Investing HOW TO INVEST IN SILVER: Silver IRA Investing

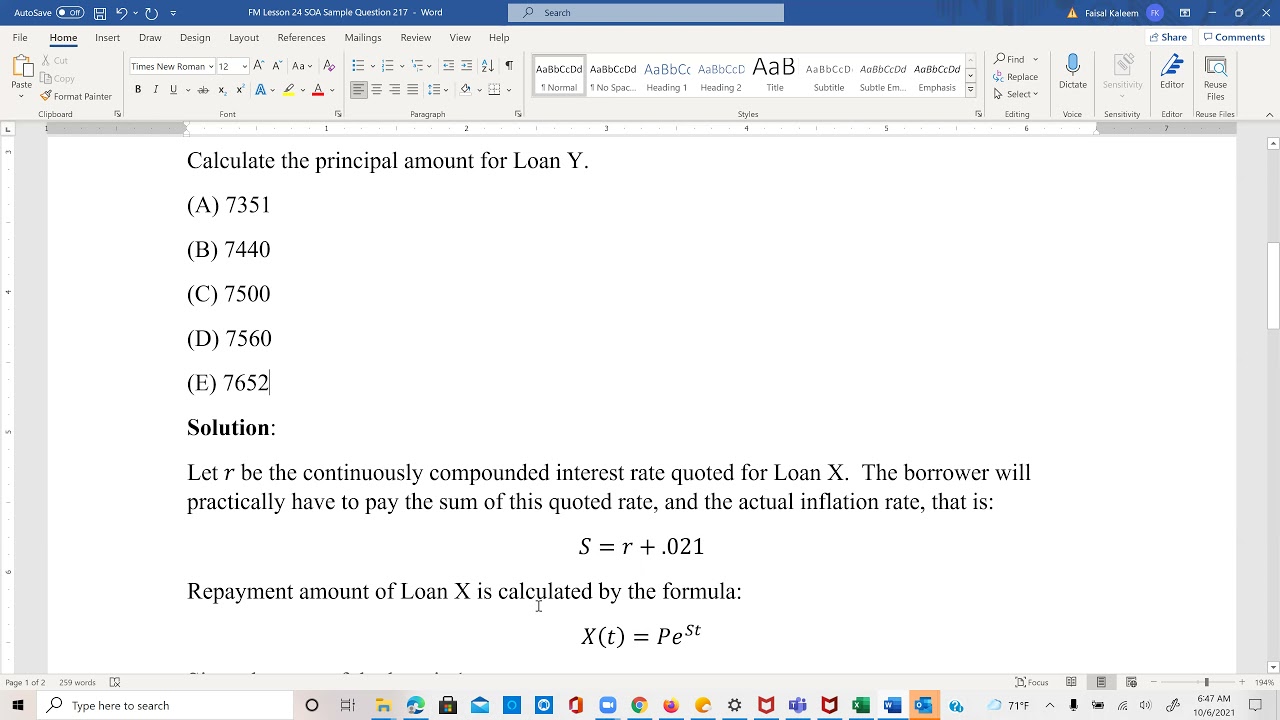

Inflation Protection of Loans When it comes to loans, one of the key concerns for both borrowers and lenders is inflation. Inflation is the gradual increase in prices of goods and services over time, and it erodes the purchasing power of money. Therefore, it is crucial to have inflation protection in place, especially when it comes to long-term loans. Actuarial professionals have a crucial role in assessing the impact of inflation on loans. They analyze various factors and develop strategies to mitigate the potential risks associated with inflation. The Society of Actuaries (SOA) CAS Actuarial FM Exam, which assesses the financial mathematics knowledge of aspiring actuaries, often includes questions related to inflation protection of loans. One such sample question from a previous FM exam is as follows: Question 217: "A bank offers a fixed-rate mortgage loan with an initial balance of $200,000 to be paid back over 30 years. The nominal interest rate is 6%, compounded monthly, and payments are made at the end of each month. The bank also offers an inflation-indexed loan with the same initial balance, interest rate, and payment structure. The inflation rate is given as 3% per year. What is the difference in the unpaid balance of the two loans after ten years?" To solve this question, candidates are required to understand the concept of inflation and its impact on loans. Inflation erodes the value of money, meaning that the purchasing power of the dollar decreases over time. Therefore, an inflation-indexed loan takes into account the inflation rate and adjusts the loan balance accordingly. To calculate the unpaid balance of each loan after ten years, the candidate must apply the appropriate formulas and calculations. This question emphasizes the importance of understanding compound interest and inflation adjustments. Actuaries must be able to determine the present value of future cash flows, account for the inflation rate, and apply appropriate discounting and indexing techniques. Preparing for such questions on the SOA CAS Actuarial FM Exam requires a systematic and comprehensive study plan. Aspiring actuaries should review the relevant study materials, such as textbooks and practice exams, to enhance their understanding of financial mathematics principles and application. Understandably, this sample question represents a simplified scenario. In real-life situations, there are additional complexities that actuaries must consider, such as varying inflation rates over time and potential adjustments in loan terms. However, questions like this provide a foundation for actuaries to develop their skills in assessing inflation's impact on loans. In conclusion, inflation protection of loans is a critical consideration for both borrowers and lenders. Actuarial professionals play a significant role in assessing and managing the risks associated with inflation. Candidates preparing for the SOA CAS Actuarial FM Exam must have a solid understanding of financial mathematics principles, including compound interest and inflation adjustments. By addressing sample questions like this one, aspiring actuaries can enhance their preparation and increase their chances of success in their future actuarial careers. https://inflationprotection.org/exam-prep-for-actuarial-fm-previous-sample-question-217-maintaining-loan-value-against-inflation/?feed_id=131083&_unique_id=64e9319645595 #Inflation #Retirement #GoldIRA #Wealth #Investing #inflationinvestmentstrategy #inflationprotection #inflationprotectionstrategies #investagainstinflation #InflationHedge #inflationinvestmentstrategy #inflationprotection #inflationprotectionstrategies #investagainstinflation

Comments

Post a Comment