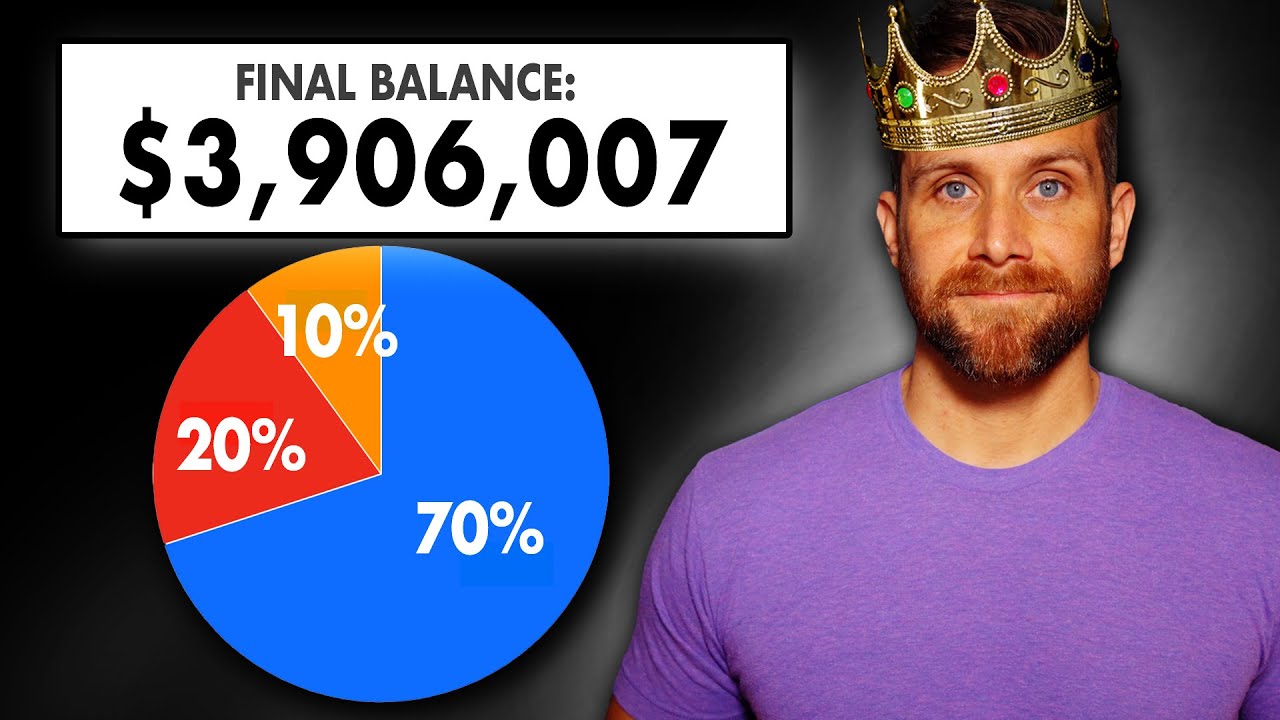

There’s a very easy “do it yourself” method to investing that not only outperforms the vast majority of retail and professional investors, but also saves you a ton of time, energy, and money along the way. And that investing method is called...wait for it...The 3 Fund Investment Portfolio. In this video, I’ll show you what makes the 3 fund portfolio so successful, the steps to properly create this portfolio in your own account...which aren’t always so obvious, I’ll give you a list of the funds needed to create the portfolio, and show you the actual historical returns based on a few backtested 3 fund portfolios I put together. Check Out My Recommendations (It helps support the channel): 🔥 M1 FINANCE Investing- Free $10 (once you deposit at least $100 within 30 days) Here's a video on how to use M1 Finance 📝 Empower (previously called "Personal Capital")- Free Net Worth Tracker & Retirement Planner 🔒 AURA - 14 day free trial to see if your personal information has been leaked online 💎 WEBULL - Up to 12 Free Stocks When You Deposit Any Amount Of Money 💵 ROBINHOOD - 1 Free Stock Join the Private Financial Independence Community for monthly private live streams, video calls (with myself and the community), as well as access to a discord group where we talk all things money (and a lot more): 📧 Business Inquiries: JarradMorrowYT@gmail.com 00:00 Intro 00:46 What Is The 3 Fund Portfolio? 01:43 Benefits Of Using Total Market Index Funds 02:15 3 Fund Portfolio Benefit #1 02:33 3 Fund Portfolio Benefit #2 05:01 3 Fund Portfolio Benefit #3 06:14 3 Fund Portfolio Benefit #4 08:09 3 Fund Portfolio Benefit #5 09:05 The 3 Funds To Invest In 11:07 3 Fund Portfolio Asset Allocation 14:33 International Asset Allocation 15:20 When To Rebalance 3 Fund Portfolio 15:42 How To Apply The 3 Fund Portfolio Affiliate Disclaimer: Some of the above may be affiliate links. Support the channel by signing up or purchasing through those links at no additional cost to you. I appreciate you for helping me keep this channel running Disclaimer: This video is for entertainment purposes only. Everyone's situation is different so do your own research before making any decisions with your money. If you need help then contact a Certified Financial Fiduciary before trying anything that is mentioned in this video. I prefer a Fiduciary financial advisor that charges an hourly fee as opposed to an ongoing fee based on a % of your portfolio. Always remember that incentives determine the type of advice they give you so one that charges an hourly fee is less likely to be problematic....(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

Why The 3 Fund Portfolio Is King Achieving financial success is a goal that many individuals strive towards. Whether it be saving for retirement, purchasing a home, or simply building wealth, investing is often seen as a viable means of achieving these goals. However, the world of investing can be complex and overwhelming, with countless options and strategies to choose from. One investment strategy that has gained significant popularity and is often hailed as the king of portfolios is the 3 fund portfolio. The 3 fund portfolio refers to a simple, yet highly effective investment strategy that involves investing in just three broad index funds: a total stock market fund, a total international stock market fund, and a total bond market fund. The beauty of this approach lies in its simplicity and diversification. Diversification is a key principle of investing. By holding a variety of assets, investors can minimize their risk exposure and spread it across different sectors and markets. The 3 fund portfolio achieves this by investing in different asset classes. The total stock market fund provides exposure to the entire U.S. stock market, including both large and small-cap stocks. The total international stock market fund gives investors exposure to companies outside of the United States, allowing them to benefit from the growth of global economies. Lastly, the total bond market fund helps to provide stability and income through fixed-income investments. Furthermore, the 3 fund portfolio is known for its low costs. By investing in index funds, which are passively managed and mimic a specific market index, investors can avoid the high fees associated with actively managed funds. This cost advantage can significantly impact long-term returns, allowing investors to keep more of their hard-earned money. Another compelling reason why the 3 fund portfolio is considered king is its historical performance. Numerous studies have shown that holding a diversified portfolio of low-cost index funds can outperform more complex investment strategies, including those managed by professionals. This is because actively managed funds often struggle to consistently beat the market after accounting for fees and other expenses. By keeping costs low and focusing on broad market exposure, the 3 fund portfolio provides investors with a higher probability of long-term success. Additionally, the 3 fund portfolio requires minimal effort to maintain. Unlike other investment strategies that require constant rebalancing and monitoring, the simplicity of this portfolio allows investors to spend less time managing their investments and more time focusing on other aspects of their lives. This hands-off approach is particularly appealing to those with busy schedules or limited knowledge about investing. In conclusion, the 3 fund portfolio has earned its reputation as the king of portfolios for several reasons. Its simplicity, diversification, low costs, and historical performance make it an ideal choice for both novice and experienced investors. By investing in just three broad index funds, individuals can achieve their financial goals and enjoy peace of mind, knowing that their portfolio is well-positioned for long-term success. So, if you're looking to build a solid investment strategy, consider the 3 fund portfolio as your royal path to financial prosperity. https://inflationprotection.org/the-dominance-of-the-3-fund-portfolio/?feed_id=127786&_unique_id=64dbf49997240 #Inflation #Retirement #GoldIRA #Wealth #Investing #3fundetfportfolio #3fundinvestmentportfolio #3fundportfolio #3fundportfoliofidelity #3fundportfoliovanguard #boglehead3fundportfolio #bogleheadportfolio #Bogleheads #bogleheads3fund #bogleheads3fundportfolio #bogleheadsthreefundportfolio #indexfunds #investing101 #JackBogle #jarradmorrow #JohnBogle #lazy3fundportfolio #passiveinvesting #simpleinvestingforbeginners #stockmarketforbeginners #threefundportfolio #vanguardindexfunds #VanguardIRA #3fundetfportfolio #3fundinvestmentportfolio #3fundportfolio #3fundportfoliofidelity #3fundportfoliovanguard #boglehead3fundportfolio #bogleheadportfolio #Bogleheads #bogleheads3fund #bogleheads3fundportfolio #bogleheadsthreefundportfolio #indexfunds #investing101 #JackBogle #jarradmorrow #JohnBogle #lazy3fundportfolio #passiveinvesting #simpleinvestingforbeginners #stockmarketforbeginners #threefundportfolio #vanguardindexfunds

Comments

Post a Comment