Vanguard ROTH IRA Account: explore the option of selling and repurchasing cover call options contracts

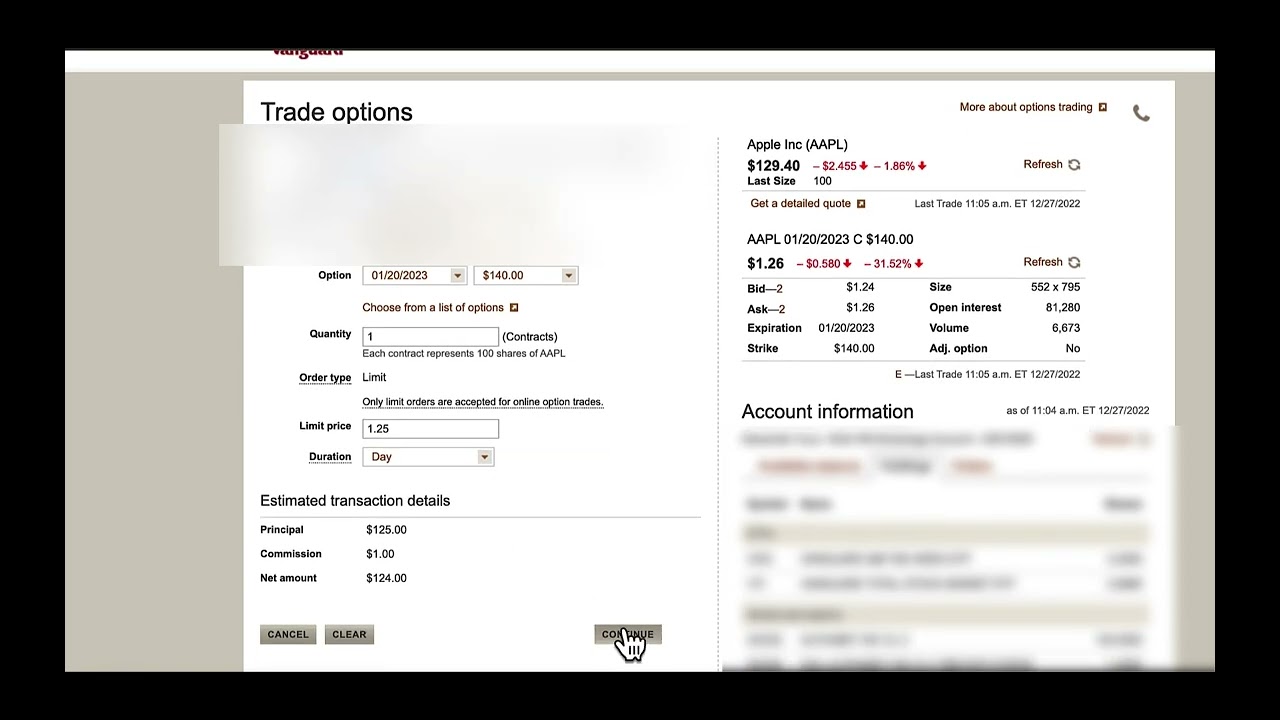

This video tutorial shows you how to sell a covered call in the Vanguard platform. The second part of the video will show you how to buy the contract back....(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

Selling and Buying Back Covered Call Options Contracts in a Vanguard ROTH IRA Account Covered call options are a popular strategy for generating additional income from stock holdings within a retirement account. Vanguard, one of the largest investment management firms, offers investors the capability to trade options, including covered calls, within their ROTH IRA accounts. In this article, we will explore how to sell and buy back covered call options contracts in a Vanguard ROTH IRA account. First, let's understand the basics of covered call options. A covered call is an options strategy where an investor sells a call option on a security that they already own. By doing so, they receive a premium from the buyer of the call option. This premium can provide additional income to the investor while still allowing them to benefit from any potential growth in the underlying stock. To sell a covered call option in your Vanguard ROTH IRA account, you would need to follow these steps: 1. Log in to your Vanguard account: Access your Vanguard account using your username and password. 2. Navigate to the "Trading" tab: Once logged in, locate the "Trading" tab on the top menu and click on it. This will bring you to the trading section of your account. 3. Choose the "Options" tab: Within the trading section, you will find various trading options. Select the "Options" tab to access options trading. 4. Select the desired security: In this step, you will need to select the security you want to sell a covered call on. Use the search function to find the specific security, and once located, click on it to proceed. 5. Choose the expiration date and strike price: After selecting the security, you will be prompted to choose the expiration date and strike price for your covered call option. These factors will determine the potential premium you can receive. 6. Review and submit the trade: Before submitting your trade, ensure that you carefully review the details of the covered call option, including the premium amount, expiration date, and strike price. If you are satisfied with the terms, proceed to submit the trade. Now that you have sold a covered call option in your Vanguard ROTH IRA account, you may wonder how to buy it back if you wish to close the position before expiration. The process is relatively similar to selling a covered call option, with a few differences: 1. Log in to your Vanguard account: Access your Vanguard account using your username and password. 2. Navigate to the "Trading" tab: Once logged in, locate the "Trading" tab on the top menu and click on it. 3. Choose the "Options" tab: Within the trading section, select the "Options" tab. 4. Select the desired security: Find the security on which you have sold the covered call option and click on it. 5. Choose the option contract to close: In this step, you will need to locate the specific option contract you want to buy back. Look for the contract with the same expiration date and strike price as the one you sold. 6. Review and submit the trade: Carefully review the details of the buyback trade and confirm that it matches the option contract you want to close. If everything looks correct, submit the trade. It's essential to note that buying back a covered call option before expiration may result in a profit or loss, depending on the premium paid to repurchase the option. It's crucial to evaluate your investment objectives and consult a financial advisor before engaging in options trading within your retirement account. In conclusion, buying and selling covered call options contracts within a Vanguard ROTH IRA account can be a useful strategy for generating additional income. By following the steps outlined above, investors can seamlessly execute these trades and potentially enhance their retirement portfolio. However, it's crucial to understand the risks and consult with a financial advisor before engaging in options trading. https://inflationprotection.org/vanguard-roth-ira-account-explore-the-option-of-selling-and-repurchasing-cover-call-options-contracts/?feed_id=126967&_unique_id=64d8a71ae2f14 #Inflation #Retirement #GoldIRA #Wealth #Investing #apple #coveredcall #Options #put #Stocks #trader #Trading #VanguardIRA #apple #coveredcall #Options #put #Stocks #trader #Trading

Comments

Post a Comment