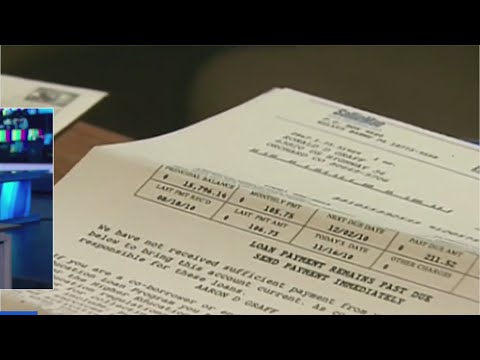

Borrowers will have to start repaying their student loans for the first time in more than three years. But between student loans and the Fed hiking rates, some analysts' predictions are worrisome. NewsNation business contributor Lydia Moynihan said some analysts fear that this could be the move that sends the economy into a possible recession.

#Recession #StudentLoans #Economy

Watch #MorningInAmerica:

Start your day with "Morning in America," NewsNation's live three-hour national morning newscast hosted by Adrienne Bankert. Weekdays starting at 7a/6C. #MorningInAmerica

NewsNation is your source for fact-based, unbiased news for all America.

More from NewsNation:

Get our app:

Find us on cable:

How to watch on TV or streaming: ...(read more)

Borrowers will have to start repaying their student loans for the first time in more than three years. But between student loans and the Fed hiking rates, some analysts' predictions are worrisome. NewsNation business contributor Lydia Moynihan said some analysts fear that this could be the move that sends the economy into a possible recession.

#Recession #StudentLoans #Economy

Watch #MorningInAmerica:

Start your day with "Morning in America," NewsNation's live three-hour national morning newscast hosted by Adrienne Bankert. Weekdays starting at 7a/6C. #MorningInAmerica

NewsNation is your source for fact-based, unbiased news for all America.

More from NewsNation:

Get our app:

Find us on cable:

How to watch on TV or streaming: ...(read more)

BREAKING: Recession News LEARN MORE ABOUT: Bank Failures REVEALED: Best Investment During Inflation HOW TO INVEST IN GOLD: Gold IRA Investing

Title: Could Student Loan Repayments Lead to a Recession? | Morning in America Introduction Despite the ongoing economic recovery process, concerns over student loan repayments and their potential impact on the broader economy are becoming increasingly significant. With outstanding student loan debt in the United States surpassing $1.7 trillion, individuals, policymakers, and economists are questioning whether this burden could potentially trigger a recession. This article delves into the interplay between student loan repayments and the possibility of a recession in America's economic landscape. The Student Loan Debt Crisis Over the past few decades, higher education costs have skyrocketed, and as a result, more and more students have resorted to taking out loans to finance their education. The consequence of this trend is an astronomical rise in student loan debt, now surpassing credit card and auto loan debt combined. As a result, millions of graduates and young professionals face challenges in managing their finances due to their hefty loan repayments. It is estimated that approximately 45 million Americans currently bear the burden of student loan debt. The monthly financial obligations can be overwhelming, hindering their ability to invest, save, and contribute to economic growth. This situation raises questions about the wider implications of this mounting debt on the national economy, potentially leading to a recession. Impacts on Consumer Spending and Economic Growth One of the primary concerns regarding student loan repayments is the impact on consumer spending, which drives a significant portion of the U.S. economy. With a substantial portion of monthly incomes being allocated towards loan servicing, borrowers often have less disposable income for other purchases. This reduced consumer spending can negatively affect numerous industries, including retail, hospitality, and leisure, potentially leading to job losses and economic contraction. Moreover, the financial strain caused by student loan repayments reduces the funds available for young professionals to invest. Inability to invest in buying a home, starting a business, or making long-term investments hampers their ability to accumulate wealth and participate fully in the economy. The Debt-to-Income Ratio and Repayment Patterns Another factor that contributes to concerns about a potential recession is the high debt-to-income ratios among borrowers. With a significant portion of their income allocated towards loan repayments, young professionals face challenges in qualifying for mortgages or securing other loans, limiting their purchasing power. This can negatively impact the housing market and slow down overall economic activity. Despite various initiatives aimed at easing the repayment burden, such as income-driven repayment plans, debt forgiveness programs, or refinancing options, these measures only provide temporary relief. Additionally, the current economic environment, combined with the uncertainty caused by the COVID-19 pandemic, has further exacerbated the difficulties faced by borrowers, increasing the likelihood of a recession. Conclusion While it remains speculative to definitively state that student loan repayments will directly trigger a recession, the immense burden they impose on borrowers and their potential long-term effects on the national economy are causes for concern. Without addressing the underlying issues associated with ever-increasing student loan debt, the nation may face fiscal challenges, weakened economic growth, and reduced financial mobility for its younger population. To mitigate these risks, policymakers should prioritize finding solutions that alleviate the burden on borrowers, such as implementing comprehensive loan forgiveness programs, improving college affordability, and enhancing financial literacy programs to prevent future generations from being burdened by excessive student loan debt. By taking proactive steps, America can ensure a brighter and more sustainable economic future, allowing students and professionals to thrive and contribute to a prosperous "Morning in America." https://inflationprotection.org/is-it-possible-for-student-loan-repayments-to-cause-a-recession-a-morning-in-america/?feed_id=145755&_unique_id=652aaa84ab576 #Inflation #Retirement #GoldIRA #Wealth #Investing #borrowers #Finances #financial #money #recession #repayments #studentloanpayments #studentloanrepayments #studentloans #students #WatchMorningInAmerica #RecessionNews #borrowers #Finances #financial #money #recession #repayments #studentloanpayments #studentloanrepayments #studentloans #students #WatchMorningInAmerica

Comments

Post a Comment