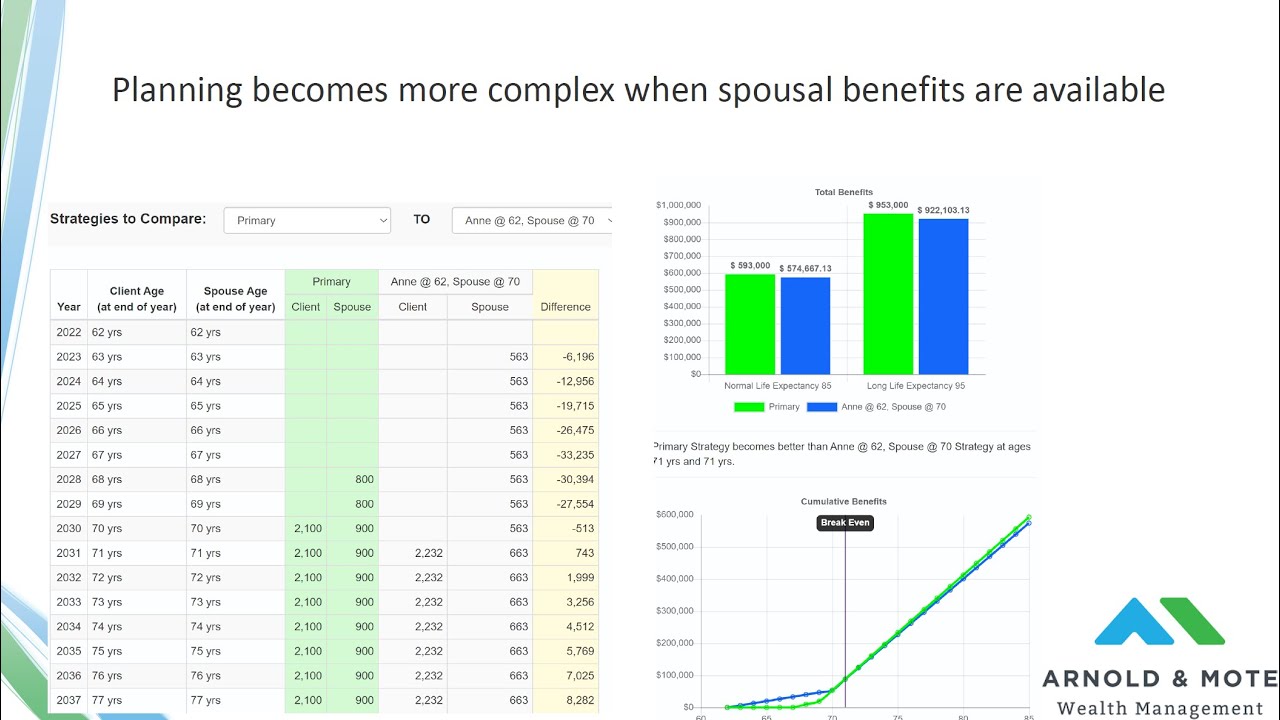

Although many of the complicated strategies around Social Security regarding spousal benefits have been eliminated, there are still options to consider regarding when to begin your, or your spousal, benefits with Social Security. In this webinar we covered common questions we receive about Spousal Social Security benefits, and strategies to maximize your benefits. Topics include: - Scenarios when it makes sense for one spouse not to delay their benefits. - The negative impact of beginning your benefit early, even if you qualify for spousal benefits. - Claiming benefits available to you from an ex-spouse. We cover 3 examples of common mistakes we see with spousal social security benefits....(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Are you considering applying for spousal Social Security benefits? It can be a great way to maximize your retirement income and make sure you have the financial security you need to live comfortably in retirement. But understanding the rules and strategies for getting the most out of spousal Social Security benefits can be complicated. Here’s a guide to help you make the most of your spousal Social Security benefits. First, you need to understand how spousal Social Security benefits work. If you’re married, you’re eligible to receive up to half of your spouse’s Social Security benefit, depending on your own work history and the amount of Social Security benefits your spouse is eligible for. It’s important to note that you’re not eligible for spousal Social Security benefits if you’re divorced or if your spouse has passed away. Once you understand the basics of spousal Social Security benefits, there are a few strategies you can use to maximize your benefits. First, it’s important to wait until you’re at least full retirement age (66 or 67, depending on when you were born) before you start collecting spousal Social Security benefits. If you start collecting before full retirement age, your benefits will be reduced. You can also maximize your spousal Social Security benefits by taking advantage of the “file and suspend” strategy. This strategy allows you to file for Social Security benefits and then suspend them, allowing your spouse to collect spousal benefits while you continue to accrue delayed retirement credits. This can be especially beneficial if your spouse is eligible for a higher benefit than you are. Finally, it’s important to understand the tax implications of spousal Social Security benefits. If you’re married and filing jointly, up to 50% of your spousal Social Security benefits may be taxable. It’s important to factor this into your retirement planning to make sure you’re getting the most out of your benefits. Spousal Social Security benefits can be a great way to maximize your retirement income and ensure you have the financial security you need in retirement. By understanding the rules and strategies for getting the most out of your spousal Social Security benefits, you can make sure you’re getting the most out of your benefits and planning for a comfortable retirement. https://inflationprotection.org/spousal-social-security-benefits-strategy-to-maximize-your-benefits/?feed_id=73711&_unique_id=63fa2da8af57c #Inflation #Retirement #GoldIRA #Wealth #Investing #howdoessocialsecuritywork #socialsecurityat62vs67 #socialsecuritybenefits #socialsecuritybenefitsfordivorcedspouse #socialsecurityclaimingstrategies #socialsecurityretirementage #socialsecurityretirementbenefits #socialsecurityspousalbenefits #socialsecurityspousalbenefits2022 #socialsecurityspousalbenefitsexplained #socialsecurityspousalbenefitsthecompleteguide #spousalsocialsecuritybenefits #spousalsocialsecuritybenefitsexplained #SpousalIRA #howdoessocialsecuritywork #socialsecurityat62vs67 #socialsecuritybenefits #socialsecuritybenefitsfordivorcedspouse #socialsecurityclaimingstrategies #socialsecurityretirementage #socialsecurityretirementbenefits #socialsecurityspousalbenefits #socialsecurityspousalbenefits2022 #socialsecurityspousalbenefitsexplained #socialsecurityspousalbenefitsthecompleteguide #spousalsocialsecuritybenefits #spousalsocialsecuritybenefitsexplained

Comments

Post a Comment