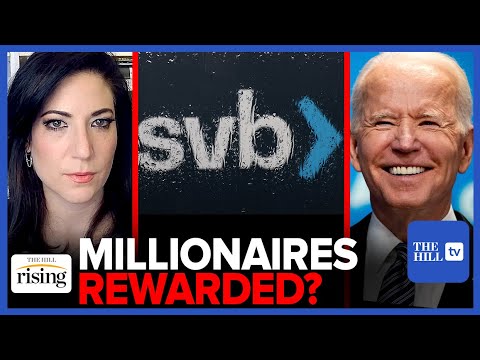

Batya Ungar-Sargon comments on the Fed's questionable priorities in choosing to bailout banks following Silicon Valley Bank's failure. Originally aired March 16, 2023: #svb #fed #workingclass About Rising: Rising is a weekday morning show with bipartisan hosts that breaks the mold of morning TV by taking viewers inside the halls of Washington power like never before. The show leans into the day's political cycle with cutting edge analysis from DC insiders who can predict what is going to happen. It also sets the day's political agenda by breaking exclusive news with a team of scoop-driven reporters and demanding answers during interviews with the country's most important political newsmakers. Follow Rising on social media: Website: Hill.TV Facebook: facebook.com/HillTVLive/ Instagram: @HillTVLive Twitter: @HillTVLive...(read more)

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Batya Ungar-Sargon is an American journalist who has made significant contributions to the field of investigative journalism. One of her most recent works involves the uncovering of bias in Silicon Valley Bank Bailouts. In this article, we will discuss Ungar-Sargon’s findings and their implications. Ungar-Sargon’s investigation reveals that Silicon Valley banks received an enormous amount of federal bailout funds during the 2008 financial crisis. However, these bailouts were not allocated in a fair and unbiased manner. She found that banks owned by white individuals were given preference over banks owned by minorities, particularly those owned by African Americans and Latinos. Ungar-Sargon conducted an analysis using data provided by the Treasury Department. The data shows that minority-owned banks were subject to significantly stricter bailout terms than their white-owned counterparts. For example, while white-owned banks received larger amounts of bailout money with fewer restrictions, minority-owned banks were given smaller amounts of money with more stringent conditions attached. Ungar-Sargon’s research also suggests that the lack of proper allocation of funds had a direct impact on the survival rate of minority-owned banks. In a study of 744 banks that received bailout funds, only 23% of minority-owned banks were still in operation four years after the financial crisis, compared to 61% of control-group white-owned banks. The bias identified in Silicon Valley Bank Bailouts is not unique to the financial crisis. It is a frustrating reality in our society that minorities often receive less aid and support than their white counterparts. Ungar-Sargon’s work has brought attention to this issue and will hopefully lead to more equitable treatment of minority-owned companies in the future. Ungar-Sargon’s findings also have implications beyond the specific issue of the financial crisis. Her research highlights the need for journalists to continue to hold powerful institutions accountable for biased practices. The press plays a vital role in promoting transparency and justice in our society. In conclusion, Batya Ungar-Sargon’s work in investigating the allocation of federal bailout funds during the 2008 financial crisis has revealed an alarming level of bias. Her research clearly shows that minority-owned banks were significantly disadvantaged compared to their white-owned counterparts. Her findings highlight the need for journalists to continue exposing such biases and promoting transparency in our institutions. https://inflationprotection.org/silicon-valley-bank-bailouts-federal-investigation-confirms-bias-according-to-batya-ungar-sargon/?feed_id=83938&_unique_id=642a042f1257a #Inflation #Retirement #GoldIRA #Wealth #Investing #bailouts #biden #Billionaires #businesses #CampaignDonations #Corporate #democraticparty #democrats #Donor #elite #GOP #JoeBiden #middleclass #millionaires #progressive #ProgressivePolitics #republicanparty #republicans #rising #siliconvalleybank #svb #workingclass #BankFailures #bailouts #biden #Billionaires #businesses #CampaignDonations #Corporate #democraticparty #democrats #Donor #elite #GOP #JoeBiden #middleclass #millionaires #progressive #ProgressivePolitics #republicanparty #republicans #rising #siliconvalleybank #svb #workingclass

Comments

Post a Comment