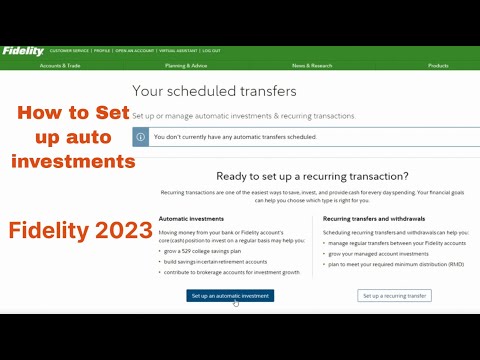

This quick video will show you how to set up automatic recurring investments on Fidelity. You can add any ETF or mutual fund to the plan. Please LIKE if the video was helpful and comment any questions you have. Thanks for watching...(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERT IRA TO GOLD: Gold IRA Account

CONVERT IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Setting up automatic recurring investments on a Fidelity SIMPLE plan is an easy way to invest regularly and help grow your retirement savings. Here’s a step-by-step guide on how to get started: Step 1: Log in to your Fidelity account and go to the “Investment” tab. Step 2: Click on “Automatic Investments” under the “Service & Support” section. Step 3: Select “Set up automatic investments.” Step 4: Choose your investment account and the investment you’d like to make recurring contributions into. Step 5: Decide on your contribution frequency (weekly, bi-weekly, monthly, etc.) and the amount you want to contribute. Step 6: Select the start and end date for your recurring contributions. Step 7: Confirm your investment details and click “Next.” Step 8: Choose how you’d like to fund your investment (direct deposit, transfer from another account, etc.) Step 9: Set up your funding source by filling in your bank details and confirming your investment. Step 10: Review your automatic investment plan and click “Submit” to set it up. Congratulations! You’ve successfully set up automatic recurring investments on your Fidelity SIMPLE plan. Your contributions will now be automatically deducted from your bank account and invested into your chosen investment on a set schedule. It’s important to note that you can make changes to your automatic investment plan at any time. Fidelity allows you to adjust the contribution amount, frequency, or investment at any time to match your changing financial goals. Investing regularly is crucial to building wealth over time, and automatic recurring investments make it easy to stay on track. With a Fidelity SIMPLE plan, setting up automatic investments is a straightforward process that helps you invest smarter and secure your financial future. https://inflationprotection.org/setting-up-automatic-recurring-investments-on-fidelity-made-simple-2023/?feed_id=100710&_unique_id=646de3bd8fab2 #Inflation #Retirement #GoldIRA #Wealth #Investing #auto #automatic #fidelity #howto #investing #Investments #ira #recurring #ROTH #SetUp #setup #simplesteps #FidelityIRA #auto #automatic #fidelity #howto #investing #Investments #ira #recurring #ROTH #SetUp #setup #simplesteps

Comments

Post a Comment