#뱅가드펀드 #RothIRA #뱅가드IRA #미국개인은퇴연금 #개인은퇴연금투자 #IRA 미국 최고의 투자회사 중 하나인 뱅가드에서 아이디를 만들고 계정을 생성하여 펀드를 사는 과정을 설며드립니다. 조만간 받게 될 스티뮬러스 체크 (Stimulus Check) 를 시드머니로 하여 은퇴, 교육, 목돈 장만 목표로 돈을 불리실 분들에게 도움이 되었으면 합니다....(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

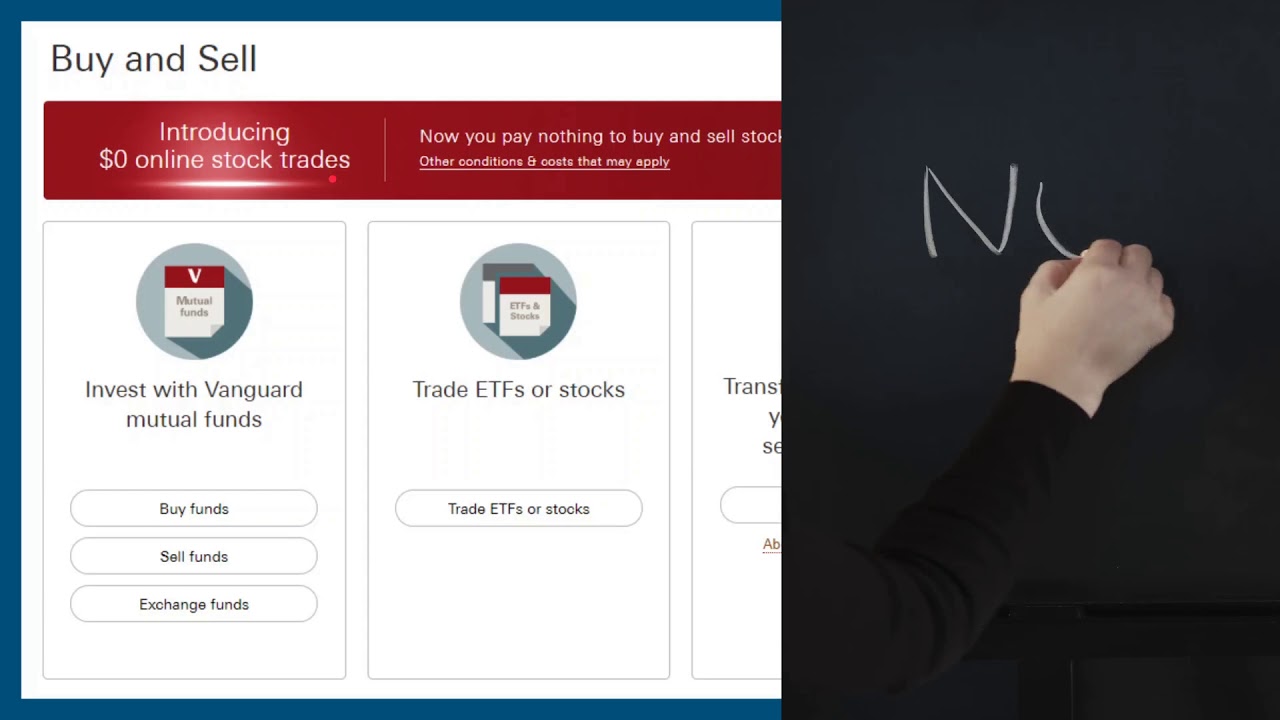

Creating a Roth IRA Account at Vanguard - Part 01 - Setting Up and Linking Your Bank If you're thinking about saving for retirement, opening a Roth IRA account is a great way to start. A Roth IRA offers significant tax advantages and can ensure a comfortable retirement for you in the long run. In this two-part article series, we will guide you through the process of creating a Roth IRA account at Vanguard, one of the leading investment management companies. In Part 01, we will discuss how to set up your Vanguard account and link it to your bank. So, let's dive right in. First and foremost, visit the Vanguard website and click on the "Open an Account" option. You will be directed to a page where you can choose the type of account you want to create. Since we are focusing on a Roth IRA, select the "Individual retirement account (IRA)" option. Next, you will be prompted to choose between a Traditional IRA and a Roth IRA. Opt for the Roth IRA option. Keep in mind that a Roth IRA allows your contributions to grow tax-free, while withdrawals in retirement are also tax-free. This can be highly beneficial in the future. After choosing the Roth IRA option, you will need to verify your eligibility. To contribute to a Roth IRA, you must meet specific income requirements. For the 2021 tax year, the income limit for single filers is $140,000, and for married filers, it is $208,000. If your income exceeds these limits, you may need to explore alternative retirement saving options. Once you have confirmed your eligibility, you will need to provide personal information, such as your name, address, and social security number. Vanguard takes privacy and security very seriously, so you can be assured your information is in safe hands. After filling in your personal information, you will be prompted to set up a username and password for your Vanguard account. Ensure you choose a strong password to protect your account from potential cyber threats. Next, you will need to select a funding method for your Roth IRA account. Vanguard offers various options, including linking your bank account or investing an existing Vanguard account. For this article, we will focus on linking a bank account. To link your bank account, have your bank account information readily available, including your routing and account numbers. Vanguard uses secure encryption methods to ensure the safety of your details during this process. Once you have provided your bank account information, Vanguard will verify and validate it. This step may take a couple of days, as the company carries out security checks to safeguard your account. After successfully linking your bank account, you will be able to fund your Roth IRA account. Vanguard provides several convenient options, including one-time contributions, recurring contributions, and even the option to transfer funds from another retirement account. In Part 01, we have covered the initial steps of creating a Roth IRA account at Vanguard. Now that you have set up your account and linked your bank, you are one step closer to securing your retirement future. In Part 02, we will explore in further detail how to select and manage your investments within your Roth IRA account. Remember, opening a Roth IRA account early in your career can have immense benefits due to the power of compounding interest. Take control of your financial future and start investing in your retirement with a Roth IRA at Vanguard. https://inflationprotection.org/creating-a-roth-ira-account-at-vanguard-part-01-setting-up-vanguard-and-linking-to-your-bank/?feed_id=129417&_unique_id=64e28e0e0a3ef #Inflation #Retirement #GoldIRA #Wealth #Investing #Bard #Fund #Index #ira #Korean #RothIRA #vanguard #교육 #미국 #뱅가드 #은퇴 #인덱스 #자금 #투자 #펀드 #VanguardIRA #Bard #Fund #Index #ira #Korean #RothIRA #vanguard #교육 #미국 #뱅가드 #은퇴 #인덱스 #자금 #투자 #펀드

Comments

Post a Comment