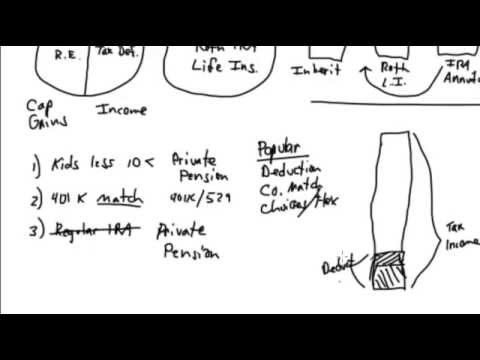

Financial planning and taxes in your retirement years does not have to be a scary thing for baby boomers and retirees. In fact, there are very simple ways to safeguard your retirement income from both volatility and taxation. In this video Rob discusses where IRA's, 401k's, and 529 Plans fit in the spectrum of taxation and financial planning. A few of the key topics in this video that you will learn are: Capital gains versus ordinary income tax Tax-free versus tax-deferred Where annuities fit in your retirement plan How a private pension is a viable alternative investment. Please subscribe to our channel above to make sure you receive updates on all future retirement videos. We post new retirement videos like this every Tuesday and Friday so please Subscribe now to get instant updates on our upcoming videos. Download the Free report at today...(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

https://inflationprotection.org/the-secret-to-retirement-planning-with-minimal-taxation/?feed_id=43163&_unique_id=6380b3bb3a4c6 #Inflation #Retirement #GoldIRA #Wealth #Investing #taxation #401ktaxes #annuitytaxation #doubletaxation #EarlyRetirement #FinancialConsultant #financialplan #FinancialPlanning #financialplanningandretirement #financialtaxes #howtocalculatetax #incometaxcalculator #irataxes #retirementplanning #retirementtaxes #taxcalculation #taxcalculator #taxesonannuities #SpousalIRA #taxation #401ktaxes #annuitytaxation #doubletaxation #EarlyRetirement #FinancialConsultant #financialplan #FinancialPlanning #financialplanningandretirement #financialtaxes #howtocalculatetax #incometaxcalculator #irataxes #retirementplanning #retirementtaxes #taxcalculation #taxcalculator #taxesonannuities

Comments

Post a Comment