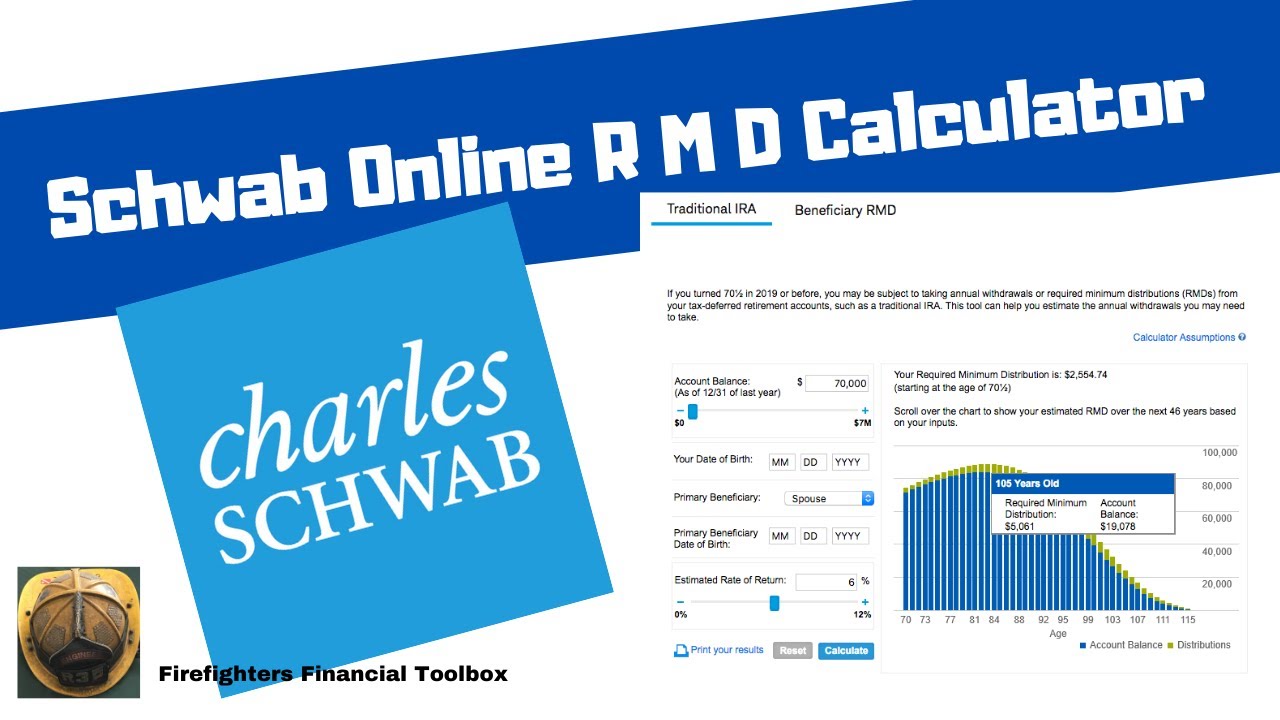

If you have any ta deferred assets, eventually you will have to take RMD's. Required Minimum Distributions. This is a handy free online tool that can show you how big those RMD's could possibly be. Here is the link to the Schwab RMD calculator Here is another video on RMD's. For my video on the SECURE Act, click here. The gear I use in my videos Canon Camcorder Vivitar Wide Angle lens USB Microphone Shotgun Microphone Green Screen Ring Light LED Video lights *these are affiliate links*...(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

When it comes to planning for your retirement, it is important to have a clear idea of the amount of money you will need to have saved. However, planning for retirement is not just about saving money but also about considering the distribution of savings. The most common method of distributing your retirement savings is through required minimum distributions (RMDs). A Schwab free online RMD calculator is a useful tool that can help you better understand and plan your RMDs. A required minimum distribution is the minimum amount of money that you must withdraw from your retirement account each year after you reach age 70½. It is the government’s way of ensuring that you eventually pay taxes on the money you’ve saved in tax-deferred retirement accounts. Failure to take the required amount annually may lead to penalties. With a Schwab free online RMD calculator, you can calculate your RMDs with ease. Whether you have an Individual retirement account (IRA) or an Inherited IRA, the RMD calculator at Schwab can help you estimate the amount of your RMDs. All you have to do is provide your age, account balance, and other relevant information about your retirement account. The calculator then does the math and gives you an estimated RMD for the year. One advantage of using the Schwab free online RMD calculator is that it is very easy to use. You don’t need any special training or knowledge of complicated formulas to use it. The calculator guides you through the process, asking you to input the necessary information and then giving you an easy-to-read estimate of your RMDs. Another advantage of using the Schwab free online RMD calculator is that it helps you plan for your distribution strategy. By providing you with an estimated RMD and allowing you to input your tax bracket and expected income, you can get a better idea of how your RMDs will affect your taxes and overall retirement income. The Schwab RMD calculator can help you make important decisions about how much money to spend or save, helping ensure that you have a comfortable retirement. In conclusion, the Schwab free online RMD calculator is a useful tool for planning your retirement income. It can help you estimate your RMDs, plan your distribution strategy, and make informed decisions about your future financial goals. With its easy-to-use interface and helpful features, the Schwab RMD calculator is an excellent resource for anyone who wants to take control of their retirement planning. https://inflationprotection.org/online-rmd-calculator-by-schwab-free-of-charge/?feed_id=100073&_unique_id=646b6b5965a53 #Inflation #Retirement #GoldIRA #Wealth #Investing #401k #457b #charlesschwab #F.I.R.E #freetools #onlinetools #planningforretirement #reitresafe #requiredminimumdistributions #Retirement #retirementplanning #rmds #RothIRA #taxes #InheritedIRA #401k #457b #charlesschwab #F.I.R.E #freetools #onlinetools #planningforretirement #reitresafe #requiredminimumdistributions #Retirement #retirementplanning #rmds #RothIRA #taxes

Comments

Post a Comment