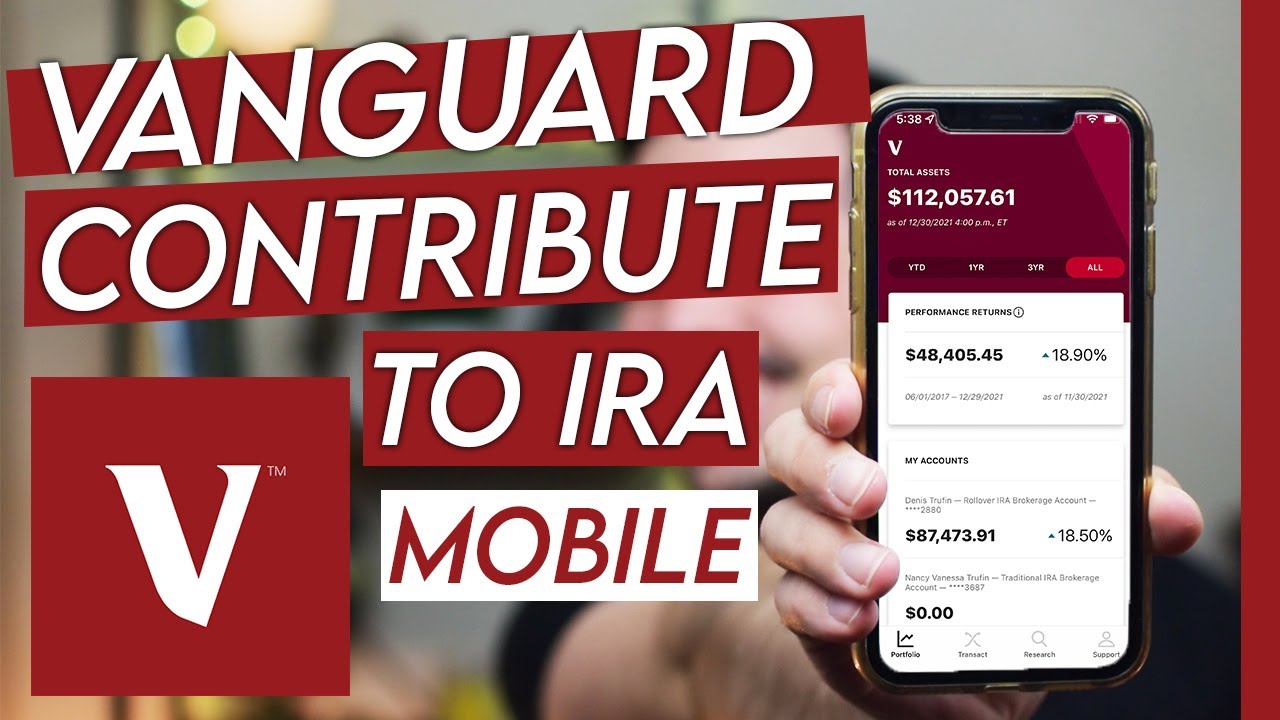

👉How To Contribute to Your IRA on Vanguard (App) Recommended resources👇 ---------- 🎓Refinance your student loans for free to lower your interest rates. $100 bonus for you when using our link: ---------- 👉Get up to $1600+ in free stocks when signing-up for investing apps by checking out: (offers subject to change) ---------- Lock in your best rate today and get your family covered with Ladder at: ---------- Looking for a place to buy crypto and earn interest? Check out BlockFi and even get up to a $250 bonus for using our link: ---------- Check your credit score for free with Credit Karma: ---------- Great online bank to use, check out SoFi Money (Get up to a $50 Bonus): ---------- For more resources check out: ---------- 🎥💰Interested in making videos for the TruFinancials channel? Reach out at contact@trufinancials.com ---------- DISCLAIMER: Please note that TruFinancials is not a financial advisor, and these videos are for entertainment purposes only. AFFILIATE DISCLOSURE: Some of the links on this page are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact our opinions or comparisons....(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

https://inflationprotection.org/how-to-contribute-to-your-ira-on-vanguard-app/?feed_id=59977&_unique_id=63c1652501c06 #Inflation #Retirement #GoldIRA #Wealth #Investing #howtoaddtoretirement #HowToContributetoYourIRA #HowToContributetoYourIRAonVanguard #HowToContributetoYourIRAonVanguardApp #vanguardapp #vanguardappaddtoretirement #vanguardapprothira #vanguardapptutorial #vanguardtutorial #vanguardtutorial2022 #VanguardIRA #howtoaddtoretirement #HowToContributetoYourIRA #HowToContributetoYourIRAonVanguard #HowToContributetoYourIRAonVanguardApp #vanguardapp #vanguardappaddtoretirement #vanguardapprothira #vanguardapptutorial #vanguardtutorial #vanguardtutorial2022

Comments

Post a Comment