In this video, I'll teach you how to build a 3 Fund Portfolio AKA The Lazy Portfolio. The 3 Fund Portfolio is an extremely popular and low maintenance investment portfolio. Some call this portfolio the "lazy portfolio" due to how easy it is to maintain. My FREE M1 Finance Training Video: Creating a long term portfolio strategy that you can "set and forget" or rebalance just a few times a year is a powerful way to build long term wealth. The reason I say this is because most people get in their own way when it comes to investing. They invest emotionally, have fear of missing out, panic sell, etc. This is not a good long-term strategy for investing. Luckily, the 3 fund portfolio fixes this. The 3 fund portfolio eliminates most of these issues because of its simplicity. Instead of checking your Robinhood account 20 times a day, you can simply dollar cost average into your 3 fund portfolio over time! Watch the entire video to understand if this is a good portfolio building strategy for you, and share the video with a friend! WBF UNIVERSITY - JOIN MY SCHOOL HERE ► LIMITED TIME - Get 1 FREE STOCK ON ROBINHOOD ► FUNDRISE - INVEST IN REAL ESTATE FOR ONLY $500 ► My FREE Stock Market For Beginners Guide ► GET MY HOME AFFORDABILITY SPREADSHEET HERE ► SCHEDULE A COACHING CALL WITH ME ► HOW TO BUY & STORE BITCOIN ► THE BEST CREDIT CARDS TO USE RIGHT NOW ► CHECK OUT MY BLOG: ► FOLLOW ME ON INSTAGRAM ► Instrumental Produced By "iAmHaywood" on IG ABOUT ME 👇 My mission is to provide my viewers with actionable content that enables them to create financial wealth. My videos are a reflection of my real-world experience as a real estate investor, stock market investor, student of finance, and entrepreneur. This channel allows me to share my passion for personal finance, stock market investing, real estate investing, and entrepreneurship. I produce content that I would want to watch, and because of that, I give 100% effort in every video that I make. I also believe in complete transparency and open communication with my audience. Subscribe if you are interested in: #Investing #3FundPortfolio #StockMarket DISCLAIMER: I am not a financial adviser. These videos are for educational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at NO additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact my opinion....(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERT IRA TO GOLD: Gold IRA Account

CONVERT IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

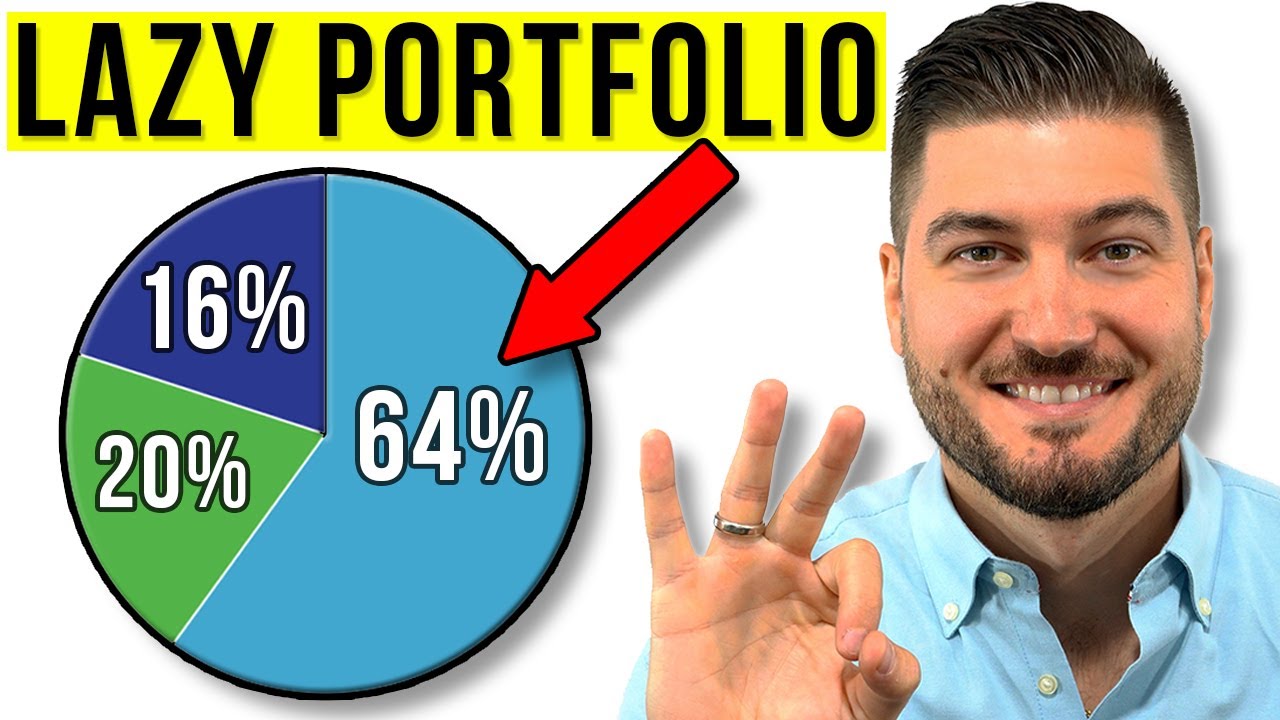

Are you looking for an easy and effective way to build a portfolio? The 3 Fund Portfolio, also known as The Lazy Portfolio, is a great option for those who want to build a diversified portfolio with minimal effort. The 3 Fund Portfolio is made up of just three funds, making it simple to manage and maintain. Here’s how to build a 3 Fund Portfolio. Step 1: Choose Your Funds The three funds that make up the 3 Fund Portfolio are a Total Stock Market Index Fund, a Total Bond Market Index Fund, and an International Stock Market Index Fund. Each of these funds represents a different asset class, giving you a diversified portfolio. Step 2: Decide Your Allocation Once you’ve chosen your funds, you need to decide how much of each to include in your portfolio. Generally, a 3 Fund Portfolio consists of 40% stocks, 40% bonds, and 20% international stocks. However, you can adjust the allocation to fit your own risk tolerance and investment goals. Step 3: Invest Now that you’ve chosen your funds and decided your allocation, it’s time to invest. You can invest in the funds directly or through a brokerage account. If you’re investing in a brokerage account, you’ll need to decide how much to invest in each fund. Generally, it’s best to invest the same amount in each fund. Step 4: Monitor and Rebalance Once you’ve invested, you’ll need to monitor and rebalance your portfolio. As the markets move, the value of your investments may change, causing your portfolio’s allocation to drift from your original plan. To keep your portfolio balanced, you should periodically rebalance it to match your original allocation. The 3 Fund Portfolio is a simple and effective way to build a diversified portfolio with minimal effort. By following these steps, you can easily build your own 3 Fund Portfolio. https://inflationprotection.org/how-to-build-a-3-fund-portfolio-the-lazy-portfolio/?feed_id=73214&_unique_id=63f7e33d2e3d2 #Inflation #Retirement #GoldIRA #Wealth #Investing #CompetitionWebsiteCategory #SingingProfession #FidelityIRA #CompetitionWebsiteCategory #SingingProfession

Comments

Post a Comment