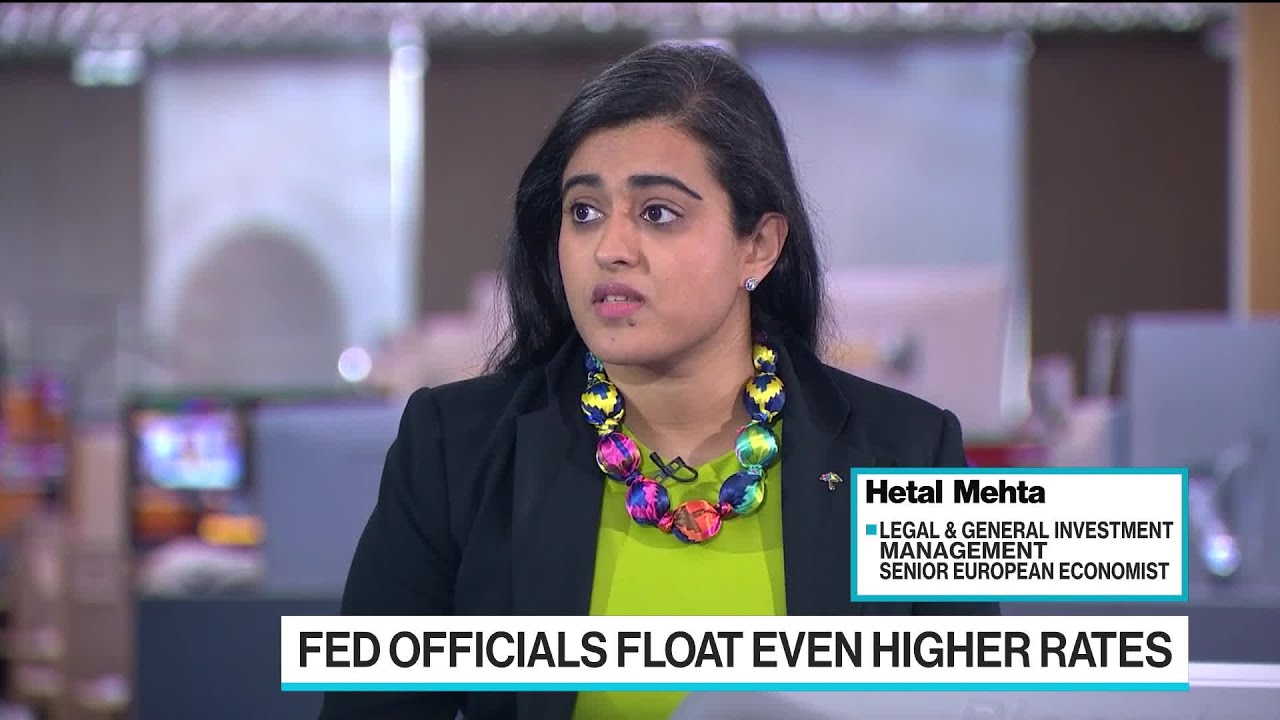

Hetal Mehta, Legal & General Investment Management Senior European Economist, discusses US inflation, global labor market dynamics and the UK economy. She speaks with Bloomberg's Francine Lacqua on "Bloomberg Surveillance: Early Edition" -------- Follow Bloomberg for business news & analysis, up-to-the-minute market data, features, profiles and more: Connect with us on... Twitter: Facebook: Instagram: ...(read more)

BREAKING: Recession News

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

In a recent interview with CNBC, Sonal Desai, Chief Investment Officer at Lombard Odier Investment Managers, talked about the need for a recession to combat inflation. According to Desai, inflation has been brewing for quite some time now and the only effective way to tamp it down is with a recession. Desai's comments have sparked a broader discussion on the same topic. As per Sonal Mehta, Senior Portfolio Manager at Legal & General Investment Management, a recession is indeed necessary to get all the inflation out. Mehta has further expounded on this view stating that "recession can bring that dislocation, that disruption that allows for price discovery and for all things to kind of reset and recalibrate". Mehta elaborated that the economic data before the coronavirus outbreak suggested that the global economy was already on shaky ground. There was a lot of exuberance in the equity markets with very low yields, and when yields go low, people reach for yield in riskier parts of the market. The economy was heading for a recession without knowing exactly when it might happen. Then came the pandemic, which created a large-scale supply shock to the global economy, causing massive dislocations in the markets. This led to fears of a deflationary environment, which moved central banks to take decisive action to create a lot of liquidity to ease financial conditions. Mehta also warned about the risks of not allowing a recession to occur. Governments have been providing huge amounts of fiscal stimulus via infrastructure, direct payments to households and businesses, and various other support measures. This massive stimulus has kept the economy afloat and been able to avoid a recession for now. However, she also points out that unless a recession is allowed and the market is given a chance to reset itself, the stimulus will have to continue indefinitely, which is neither sustainable nor healthy. This will increase the risk of even higher inflation in the long run, which could have much worse consequences. In conclusion, the call for a recession to combat inflation is a contentious one. It may seem counter-intuitive to suggest that an economic downturn would be desirable, but Mehta believes it is a necessary act for the long-term health of the economy. A recession will allow for a reset of prices and help bring inflation under control, which ultimately benefits everyone. https://inflationprotection.org/mehta-of-lgim-argues-for-recession-as-a-solution-to-eliminate-inflation/?feed_id=86885&_unique_id=6435ee4e5acfb #Inflation #Retirement #GoldIRA #Wealth #Investing #hetalmehta #LegalGeneralGroupPLC #RecessionNews #hetalmehta #LegalGeneralGroupPLC

Comments

Post a Comment