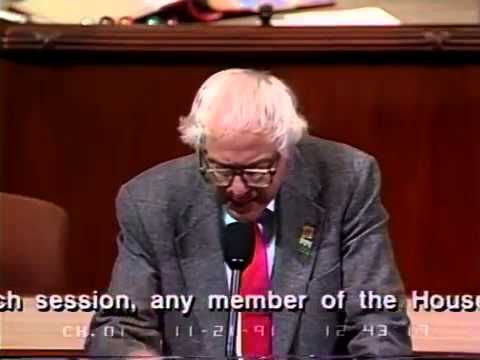

Bernie Sanders Criticizes Bank Bailouts during the S & L Crisis as "Robin Hood in Reverse!" (11/21/1991)

Rep. Bernie Sanders (I-VT) channels the anger of the American people against bank bailouts, decrying the practice of taxpayer funded banking and financial institution bailouts as Robin Hood in reverse....(read more)

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Bernie Sanders on Bank Bailouts (10) – "Robin Hood in Reverse!" (S & L Crisis) [11/21/1991] In a heated debate on Capitol Hill, Bernie Sanders, the passionate and outspoken congressman from Vermont, once again took a stand against what he saw as an injustice perpetuated by financial institutions. On November 21, 1991, Sanders delivered a fiery speech that lambasted the bank bailouts during the Savings and Loan (S&L) crisis, decrying them as a reverse Robin Hood scenario, where the poor were forced to bail out the wealthy. The Savings and Loan crisis, which began in the 1980s, was a result of reckless lending practices by S&L institutions. The federal government, concerned about the potential collapse of the banking system, decided to step in and rescue these institutions. However, instead of following a fair and just approach, Sanders argued that the bailout amounted to an unprecedented transfer of wealth from the working class to the rich. Sanders began his speech with a scathing critique of the banking industry and the political establishment, accusing them of prioritizing corporate interests over the needs of ordinary Americans. He pointed out that the S&L crisis was caused by greed and deregulation, and it was now the same people who were responsible for the crisis that were being rewarded with taxpayer money. Referring to the affluent banks and financial institutions who had received government aid, Sanders exclaimed, "These are Robin Hoods in reverse! They are taking from the poor and giving to the rich." This powerful statement resonated with many Americans who were growing increasingly frustrated with a system that seemed to favor the elite at the expense of the average citizen. Sanders argued that instead of protecting those who caused the crisis, the government should have focused on helping the victims—those who had lost their homes, their jobs, and their livelihoods. He proposed alternative solutions that would have held the responsible parties accountable and prevented similar crises in the future. Even though his arguments were met with resistance from some members of Congress and financial lobbyists, Sanders' passionate defense of the working class struck a chord with many Americans. His speech became a rallying call for economic justice and a call to action against corporate greed. Looking back, Sanders' criticisms of the bank bailouts during the S&L crisis seem remarkably prescient. His warnings about the dangers of corporate greed and the need for robust regulation and accountability in the financial industry have now become central themes in contemporary political debates. Sanders' impassioned speech on November 21, 1991, serves as a testament to his unwavering commitment to advocating for the interests of the working class and a reminder that the fight against inequality and injustice is an ongoing battle. It is a reminder that even in challenging times, there are champions who are willing to stand up and fight for economic fairness and restore power to the people. https://inflationprotection.org/bernie-sanders-criticizes-bank-bailouts-during-the-s-l-crisis-as-robin-hood-in-reverse-11-21-1991/?feed_id=107598&_unique_id=6489e71457d7f #Inflation #Retirement #GoldIRA #Wealth #Investing #BailoutLiteratureSubject #BankIndustry #BernieSandersU.S.Congressperson #economy #FederalReserveSystemGovernmentAgency #RobinHoodtax #SavingsAndLoanAssociationOrganizationType #SavingsAndLoanCrisisEvent #BankFailures #BailoutLiteratureSubject #BankIndustry #BernieSandersU.S.Congressperson #economy #FederalReserveSystemGovernmentAgency #RobinHoodtax #SavingsAndLoanAssociationOrganizationType #SavingsAndLoanCrisisEvent

Comments

Post a Comment