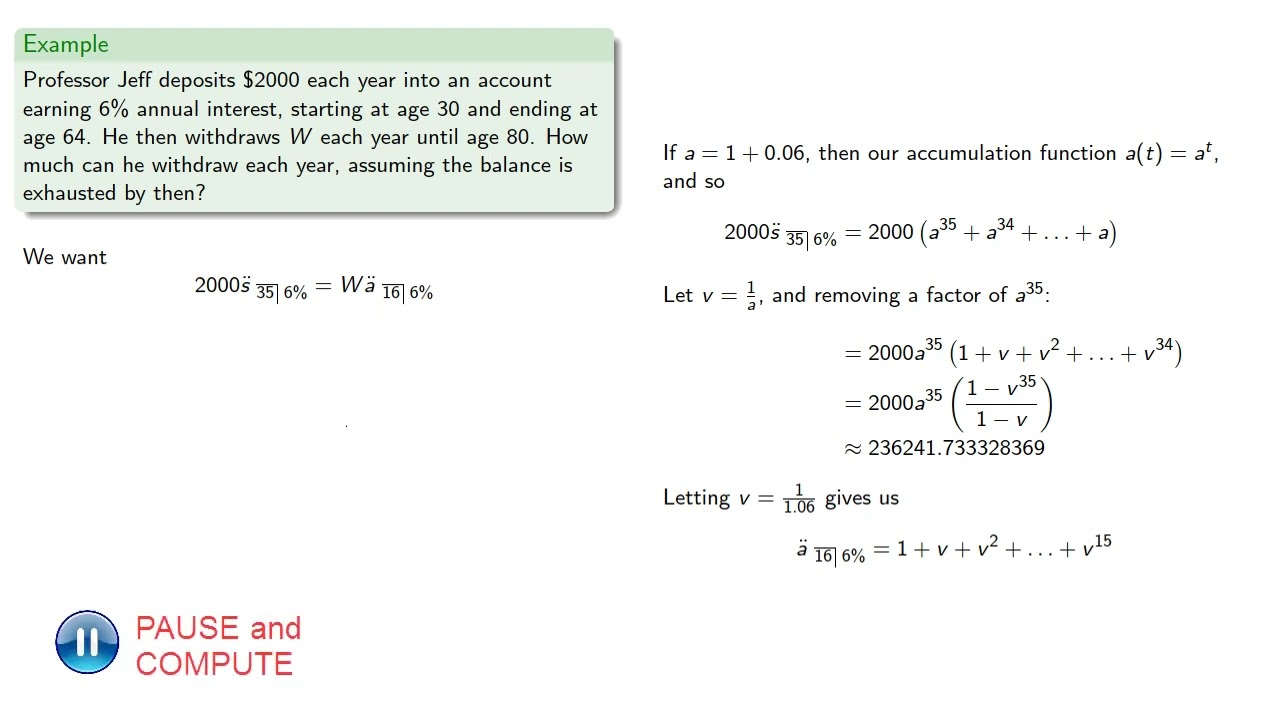

Annuity problems. To help prepare for the actuarial (FM) exam. For more math, subscribe to my channel: ...(read more)

LEARN MORE ABOUT: Retirement Annuities

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Saving for Retirement: Annuity Problems Retirement planning is an essential part of everyone's financial journey. As people work hard throughout their lives, they hope to enjoy the fruits of their labor during their golden years. One popular option for retirement savings is an annuity. However, there are several problems associated with annuities, which individuals must consider before making a decision. An annuity is essentially an investment product offered by insurance companies, often marketed as a form of income during retirement. It works like this: an individual pays a lump sum or regular contributions to an insurance company in exchange for a guaranteed income stream that begins at a predetermined time, often after retirement. While it may sound appealing, there are certain pitfalls to be aware of. First and foremost, annuities can be expensive. Insurance companies charge various fees and commissions for managing the investments within an annuity. This can significantly reduce the returns on your investment and limit the amount of income you receive during retirement. It is crucial to understand the specific costs associated with an annuity before diving in, as these fees can significantly impact your long-term financial plans. Secondly, annuities can lack flexibility and liquidity. Once you've invested your money in an annuity, it becomes challenging to access those funds. Annuities often have restrictive withdrawal conditions, such as early withdrawal penalties and limited options for changing the annuity terms. This lack of flexibility can be problematic if you find yourself needing the funds for emergencies or unexpected expenses. Additionally, annuities don't always keep pace with inflation. While they offer a fixed stream of income, the value of that income can erode over time due to inflation. As the cost of living increases, the purchasing power of your annuity payments decreases. This can pose a significant problem when you rely solely on annuities for your retirement income. It is essential to consider inflation and its impact on annuities before depending on them for your retirement needs. Furthermore, annuities may not offer the best returns compared to other investment options. While they offer stability and guarantees, annuities typically have lower returns compared to other investment vehicles such as stocks and bonds. If you're comfortable with a higher level of risk and have a longer time horizon, other investment options might provide better returns and growth potential for your retirement savings. Lastly, annuities can have complex terms and conditions that may be difficult to understand. Insurance companies often use complex language and jargon, making it challenging for individuals to fully comprehend the features and drawbacks of their annuity contracts. It is crucial to thoroughly review the terms and conditions of any annuity before investing to ensure you have a clear understanding of the potential pitfalls and benefits. While annuities can provide a source of retirement income, it is essential to carefully consider the problems associated with them. High costs, lack of flexibility, inflation erosion, lower returns compared to other investments, and complicated contracts are all factors that should be evaluated before diving into an annuity. It is always wise to consult with a financial advisor who can offer guidance tailored to your specific circumstances, helping you make informed decisions about your retirement savings. https://inflationprotection.org/challenges-with-annuities-building-retirement-savings/?feed_id=113226&_unique_id=64a0c8d24699e #Inflation #Retirement #GoldIRA #Wealth #Investing #education #mathematics #RetirementAnnuity #education #mathematics

Comments

Post a Comment